Will Commercial Mortgage-Backed Securities Take The Markets Down Like In 2008?

By Avi Gilburt in conjunction with Renaissance Research

We have been writing a lot about CRE lending and its impact on U.S. banks. Another part of this story is that quite a lot of CRE loans are packed into bonds, which are called CMBS (commercial mortgage-backed securities). There have been several interesting pieces of news that led to some notable movements in the CMBS market.

First, according to the CMBS Trend Watch, which was published by KBRA, CMBS issuance has reached $43.7B since the beginning of the year, which is already 11% higher than the full-year 2023 level, which was $39.3B. This massive increase in new CMBS is likely due to a major deterioration in the asset quality of the CRE lending segment, which pushed the banks to offload CRE loans from their balance sheets more aggressively. Obviously, a massive supply of new CMBS has put pressure on their prices.

Second, according to Trepp, which tracks CMBS delinquency rates, the overall US CMBS delinquency rate increased by 38 bps MoM to 5.35% in June, while the office CMBS delinquency rate increased by more than 60 bps MoM and reached 7.55%. More importantly, the delinquency rate of floating-rate office CMBS is as high as 24%. According to Trepp, almost 40% of total office loans packed in CMBS are floating-rate.

These delinquency rates are very likely to increase much higher, as, according to KBRA analytics, 31% of all office loans in CMBS are estimated to be in trouble. CMBS holders are eagerly trying to extend the maturities of those loans, as many of them understand how significant the losses will be if a borrower defaults.

For example, in May, holders of a $308MM CMBS note backed by the mortgage on an office building in Manhattan were hit by losses as this building was sold for $185.9MM. Notably, this CMBS note had the highest rating ((AAA)), so for the first time since the Great Recession, investors were hit by losses in an AAA-rated paper. The technical default of the paper formally occurred in 2022, when Blackstone stopped paying interest payments on this mortgage. It is also interesting that Blackstone initially paid more than $600MM for this Manhattan building back in 2014. As such, its price has dropped by almost 70% since then.

So, despite CMBS holders’ efforts to extend the maturities of loans, which were packed into these derivatives, it’s only a matter of time when these troubled loans start to default, and the respective buildings will be sold at huge discounts.

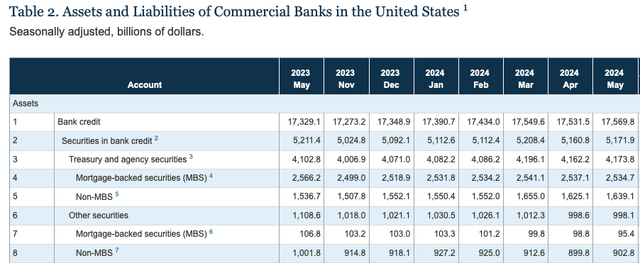

If we look at U.S. banks’ direct exposure to CMBS, then it is quite low. As of the end of May, banks held $95.4B of non-government-guaranteed MBS, and some of them were very likely residential MBS. The exposure looks especially low when compared to the more than $3T of CRE loans sitting on the U.S. banks’ balance sheets.

The Fed

As such, CMBS is a much bigger issue for insurance companies, pension funds, private equities, and other similar firms that are buying these derivatives. Importantly, it is a problem for companies with even a very conservative investment strategy, as an AAA-rated CMBS has defaulted. Many of these companies have credit lines from mostly large banks; as such, when they start posting losses from their holdings of CMBS, there will be a negative impact on banks as some of these companies will likely not be able to repay their bank credits. So, there is an indirect negative effect on large banks from all these CMBS-related issues.

Bottom line

A flow of negative data from the CMBS market is another reminder that whereas the 2007-2009 financial crisis had one main issue that caused the banking meltdown at the time, we're currently heading into an environment with multiple issues sitting on many bank balance sheets.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written. And, as these issues get worse, the risk continues to rise.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bancorp (NYCB) is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, one of the main reasons being the banking industry's desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive into the banks that house your hard-earned money to determine whether your bank is truly solid or not. You are welcome to use our due diligence methodology outlined here.