What Can You Learn From A Post-Mortem Review Of The Republic First Bank Failure?

For the last two years, we have been publishing the analysis methodology that we use to review the strength - or lack thereof - of banks across the country. So, we thought it would be a good idea to explain how performing due diligence using our methodology on Republic First Bank would have kept you from being caught in this bank failure.

Last week, there was the first bank collapse in 2024. Philadelphia-based Republic First Bank was shuttered by Pennsylvania regulators. Here is the official announcement:

Philadelphia-based Republic First Bank (doing business as Republic Bank) was closed today by the Pennsylvania Department of Banking and Securities, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect depositors, the FDIC entered into an agreement with Fulton Bank, National Association of Lancaster, Pennsylvania to assume substantially all of the deposits and purchase substantially all of the assets of Republic Bank.

Republic First Bank had total assets of almost $6B and 32 branches in New Jersey, Pennsylvania, and New York. This bank was smaller than Silicon Valley Bank or Signature Bank, which failed last year. However, Republic First Bank was still a medium-sized bank rather than a small community bank.

The bank had been showing signs of financial distress for more than three years, and in this article, we would like to show that a proper due diligence with a focus on forward-looking indicators had been indicating that this was a bank to avoid from a retail depositor perspective since 2021.

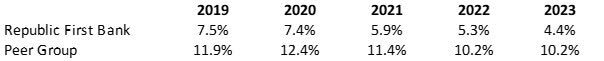

RFB's capital position was very weak

As of the end of 2023, RFB's leverage ratio was as low as 4%. By comparison, the respective metric of the peer group was 10%. More importantly, as the table below shows, RFB had been operating with a low leverage for several years.

Leverage ratio

FFIEC

It's difficult to underestimate the importance of a good leverage ratio for banks, especially in the current environment. In fact, this metric alone shows that RFB was a bank to avoid for retail depositors even in 2021.

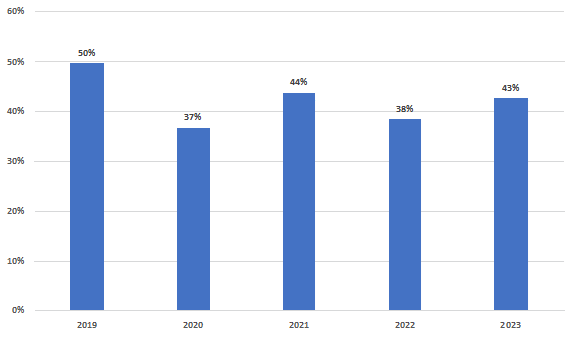

High exposure to CRE lending

We have published a lot of articles on CRE lending over the past two years. As such, if you follow our banking work, you are well aware of major issues in this loan segment.

As of the end of 2023, CRE loans accounted for more than 40% of RFB's credit portfolio. In addition, as the chart below shows, their share had been high for several years. High exposure to CRE loans coupled with a low leverage ratio, which we discussed earlier, is a major red flag. As the data shows, a proper due diligence could have revealed this issue three years ago.

RFB: Share of CRE loans

FFIEC

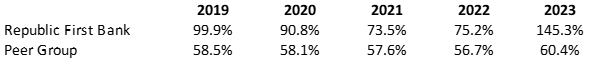

Operating efficiency was much worse than that of the peers

Another indicator that had been signaling about RFB's issues is its operating efficiency ratio. The table below shows the dynamics of efficiency ratio for RFB and its peer group. Obviously, it's just a matter of time before such a bank fails.

Operating efficiency ratio

FFIEC

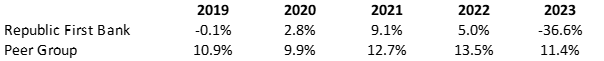

Profitability levels were subpar

One of the key reasons why RFB had a low leverage ratio was its weak organic capital generation. Here's the table that shows the dynamics of a return on equity for RFB and its peer group. Needless to say, the bank had been lagging its peer group.

Return on equity

FFIEC

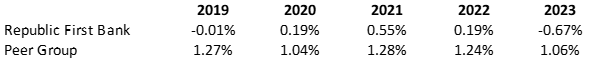

However, given that RFB had a very low leverage ratio, calculated as a bank's total equity dividend by its total assets, a return on assets is a much more useful metric. The table below shows how poor was RFB's return on assets for the past several years.

Return on assets

FFIEC

There are two key takeaways from this analysis. First, a return on assets is often more useful than a return on equity, given that the banks often have major differences in their leverage ratios. Second, as we said earlier, all those RFB's issues with weak organic capital generation could have been identified by a proper due diligence several years ago.

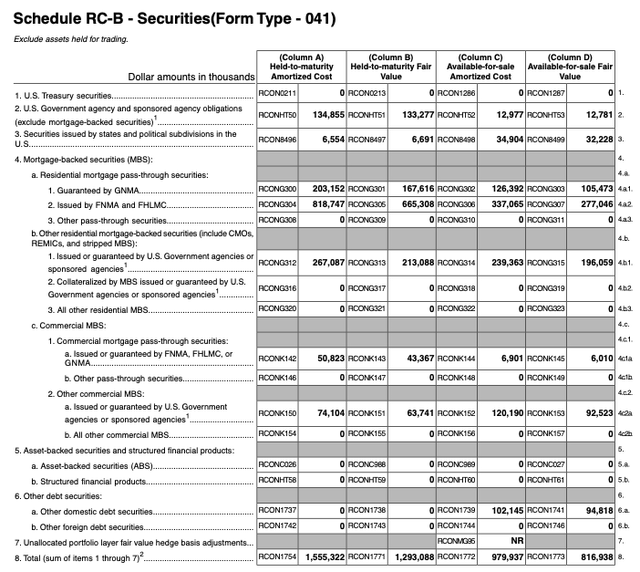

Significant exposure to long-duration bonds

Another major issue (which was also the reason for SVB's failure) is the fact that RFB had long-duration bonds. As of the end of 2023, securities accounted for more than 40% of RFB' assets, of which 35% were available-for-sale and 65% were held-to-maturity. Below is a detailed breakdown of the bank's securities portfolio. It clearly evidences a liquidity issue due to RFB having a significant amount of its holdings under water.

FFIEC

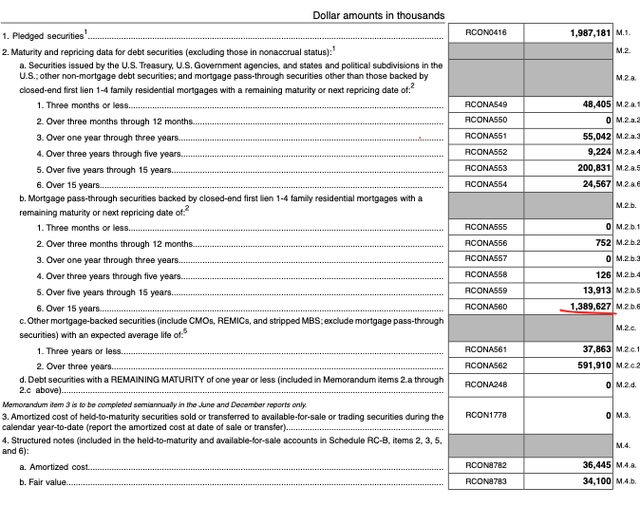

And here is a breakdown of RFB's securities by maturity. As you can see, almost all mortgage-backed securities had a duration of more than 15 years. Again, it's just a matter of time before a bank with such an enormous maturity mismatch collapses.

FFIEC

Bottom line

A proper due diligence could have identified significant risks on RFB's balance sheet several years ago and could have shown a retail depositor that RFB was a bank to avoid.

And RFB is hardly in the minority, as most U.S. banks are currently operating in a very difficult environment. In our previous articles we have discussed many potential problems, such as CRE lending, credit cards, commercial loans, car lending, risky structured products, maturity mismatches, and other issues.

So, the best course of action for investors is to find the safest banks possible. To this end, I want to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and we have published our findings over the last two years.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time before more cracks in the system become evident to the masses.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive into the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to use our due diligence methodology, which is outlined here.