Wells Fargo: Looking Even Uglier Under The Hood

Our newest article on bank safety, titled "Wells Fargo: Looking Even Uglier Under The Hood."

A common theme has emerged in the public eye that it's safer to place your money with the larger banks as compared to the smaller and regional banks due to what occurred last year. But, based upon our view of many larger banks, this is an absolute fallacy.

Three months ago, we published an article on Wells Fargo (WFC) in which we discussed the bank's Q3 numbers. In particular, we highlighted a massive spike in the bank's non-performing CRE loans.

We also noted that the situation with the bank's CRE lending book was very likely to deteriorate further as this is just the beginning of massive issues with WFC's CRE portfolio. The bank's Q4 results and the commentary from WFC's management confirmed our views. Moreover, in addition to bad results in the CRE space, WFC's Q4 numbers revealed concerning trends in its credit card business.

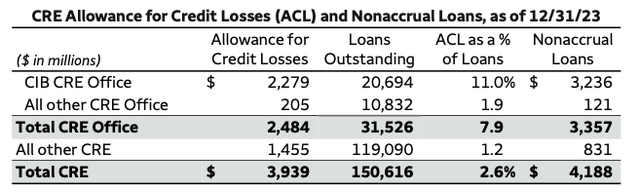

First, WFC's non-performing loans in the office-related CRE space increased by more than 20% QoQ to $4.2B. The bank's total NPL ratio in this segment reached 10.6%, which is a very high number. Moreover, WFC's NPL ratio in CIB CRE office lending was as high as 15.6%. Wells created a lot of loan loss provisions in the space, but these reserves accounted for 7.9% of all CRE office loans, i.e., lower than the 10.6% NPL ratio, and 11.0% in the CIB CRE segment, also lower than the respective NPL ratio of 15.6%.

Company Data

Here's a comment that the bank's management made about the bank's CRE book:

Losses started to materialize in our commercial real estate office portfolio as market fundamentals remained weak. The losses were across a number of loans spread across various markets and were driven by borrower performance, lower appraisals were the result of properties or loans being sold at a loss.

When the bank's CEO was asked about the longevity of CRE-related issues, he said the following:

I think, in terms of your broader point, it's a long movie. We're still - we're not - we're past the opening credits, but we're still in the beginning of the movie. And so it's going to take some time for this to play out. And as I noted, it'll be somewhat of an uneven and episodic sort of nature to the charge offs and as you work through this, because every property has a different timeline in terms of events that it needs to sort of work through. So I do think that we've got a while for this to play out through the system.

WFC's CEO has basically confirmed our views on a crisis in the CRE space, of which we have been warning our readers for the past 18 months. So, anyone following our banking analysis should not be shocked by any of his information.

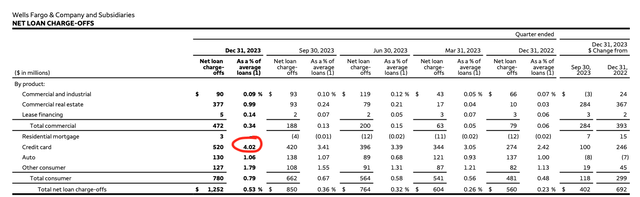

Another key takeaway from WFC's Q4 numbers is a deterioration in its credit card business. As the table below shows, the bank's net charge-off in credit cards was 4.02% in Q4, up from 3.41% in Q3. For those who follow our banking work, this should not come as a surprise, as we have published a lot of articles on the issues in the U.S. credit card segment.

Company Data

Bottom Line

TheQ4 numbers suggest that WFC could be facing a double whammy based upon the ongoing CRE crisis and a notable deterioration in the credit card business. And, believe it or not, WFC has even more issues, which we discussed in our previous articles.

I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you that WFC is not alone regarding major concerning issues sitting on the balance sheets of those banks. The substance of our analysis suggests that the future is not looking too good for the larger banks in the United States, details for which are here.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail, well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. For those looking for a due diligence methodology, our due diligence methodology is outlined here.