WARNING: You Will Lose Your Money If You Rely On The FDIC

The article below, with an intro and summation by Avi Gilburt, was produced by Jeff Avers, who was a former consultant to the FDIC:

Those of you that have been following my work over the last 14 years probably know that our main website at Elliottwavetrader.net not only has thousands of retail clients, but we also have approximately 1000 professional clients. In fact, I am personally impressed by the quality and knowledge-base of our membership on Elliottwavetrader.net.

So, this week, I want to present you with an article written by one of our professional clients. I would like to first introduce you to Jeff Avers, who was a former consultant to the FDIC, as well as many other large financial institutions. His experience includes working with large corporate banks and financial institutions (including the top 5 banks in the United States), institutional investment management, deposit and liquidity product management, institutional investment sales, and financial consulting to Wall Street, large banks and the FDIC. Among his extensive work with the FDIC, he has advised the FDIC with respect to the Large Bank Modernization Act, Bank Sweep Reform and the unintended consequences of regulatory change.

So, I asked Mr. Avers to provide us with his insight into how reliable the FDIC insurance fund would be when (not if) we experience our next banking crisis. He then penned the following article:

Will the FDIC be able to cover the next banking bailout?

We tend to think of the FDIC as our savior in the event of a massive financial crisis. If the past is any indication of the future, the FDIC will be no more equipped to rescue the banking sector and cover the losses than it was during the last several crises of our lifetime.

The FDIC’s mission statement is…

The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by the Congress to maintain stability and public confidence in the nation's financial system. The FDIC insures deposits; examines and supervises financial institutions for safety, soundness, and consumer protection; makes large and complex financial institutions resolvable; and manages receiverships.

Their results…

They have been unable to fully cover insured deposits and maintain stability and public confidence in the nation's financial system during our lifetime.

Historical Overview

Mark Twain said “history doesn’t repeat itself, but it often rhymes”. Let’s take a look at the events of the last 40 years and consider whether the next event will rhyme or play out as a different tune.

Founded in 1933 as an outgrowth of the Great Depression, the FDIC has seen a multitude of bank failures. Our focus here will be on the events that took place during our lifetime, beginning in the 1980’s.

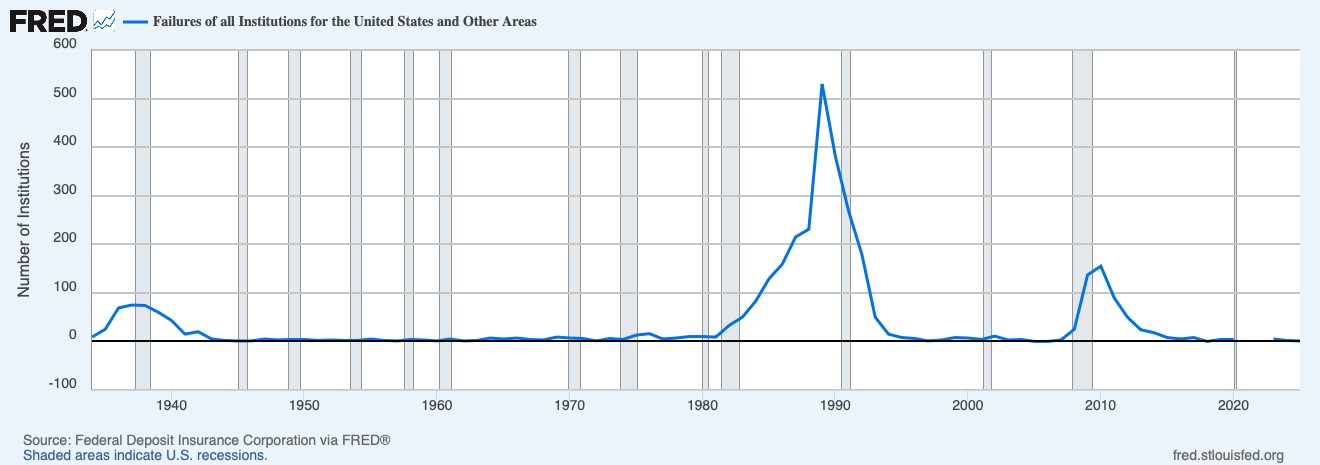

When it comes to bank failures, most of us consider the Great Depression as the grand-daddy of all time because approximately 40% of all banks that existed at the time failed. But, it may come as a complete surprise that almost three and half times (3.5X) as many banks failed in 1989 as did in 2010. The total cost of the bank failures in 1989 (160 billion) was more than one and half times (1.5X+) the cost of bank failures in 2010 (97 billion).

Now, to put this into perspective, ask yourself what regulatory agency was responsible for “examining and supervising financial institutions for safety, soundness, and consumer protection” during these latter years? Yes, my friends, that is the FDIC, and they have failed in their responsibilities.

So far, history seems to have rhymed.

Financial Condition of FDIC Insured Financial Institutions

Let’s take a look at the current health and strength of US financial institutions insured, regulated and overseen by the FDIC. Here’s a snapshot:

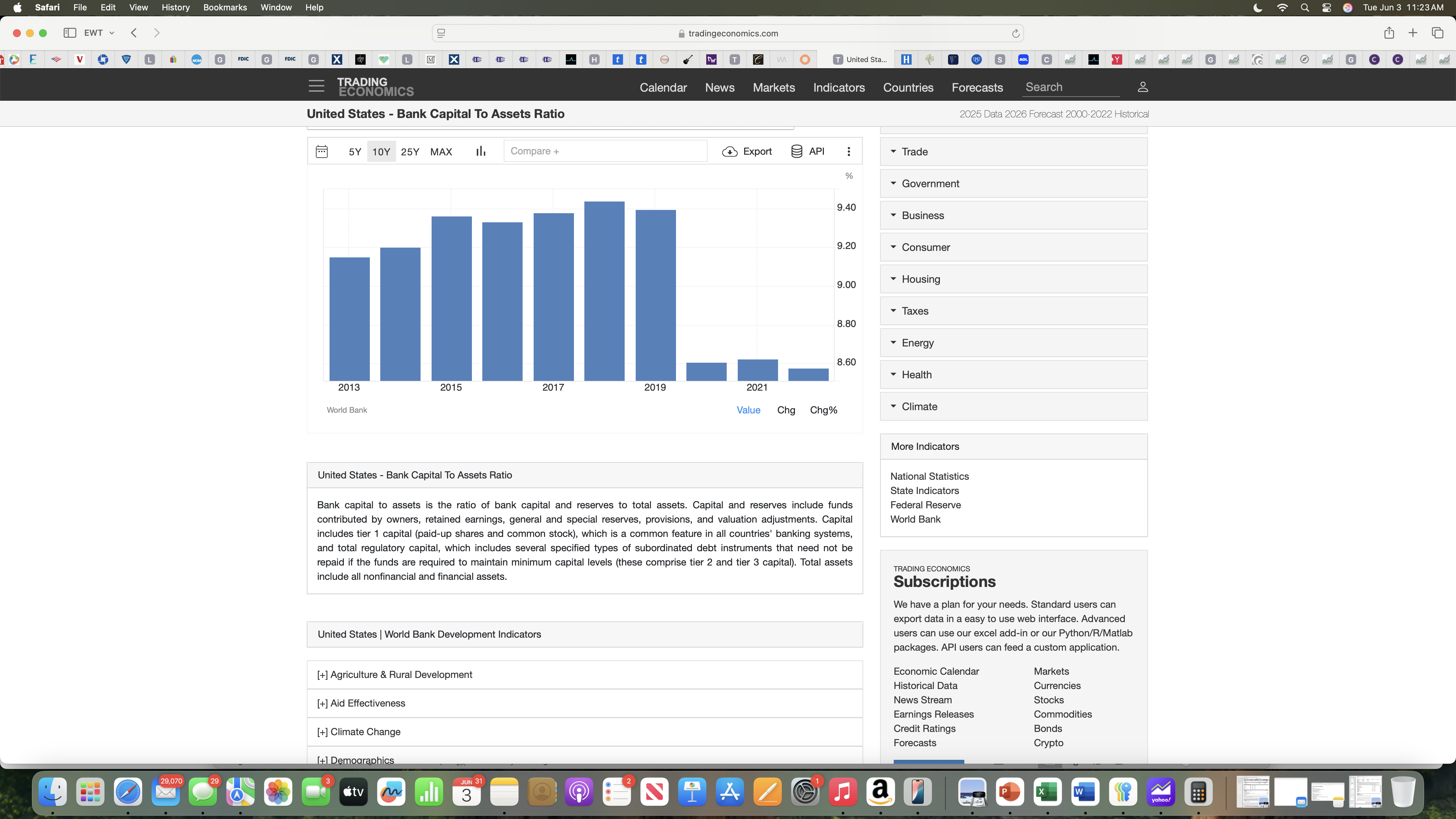

Bank Capital to Total Bank Assets has declined dramatically since 2019

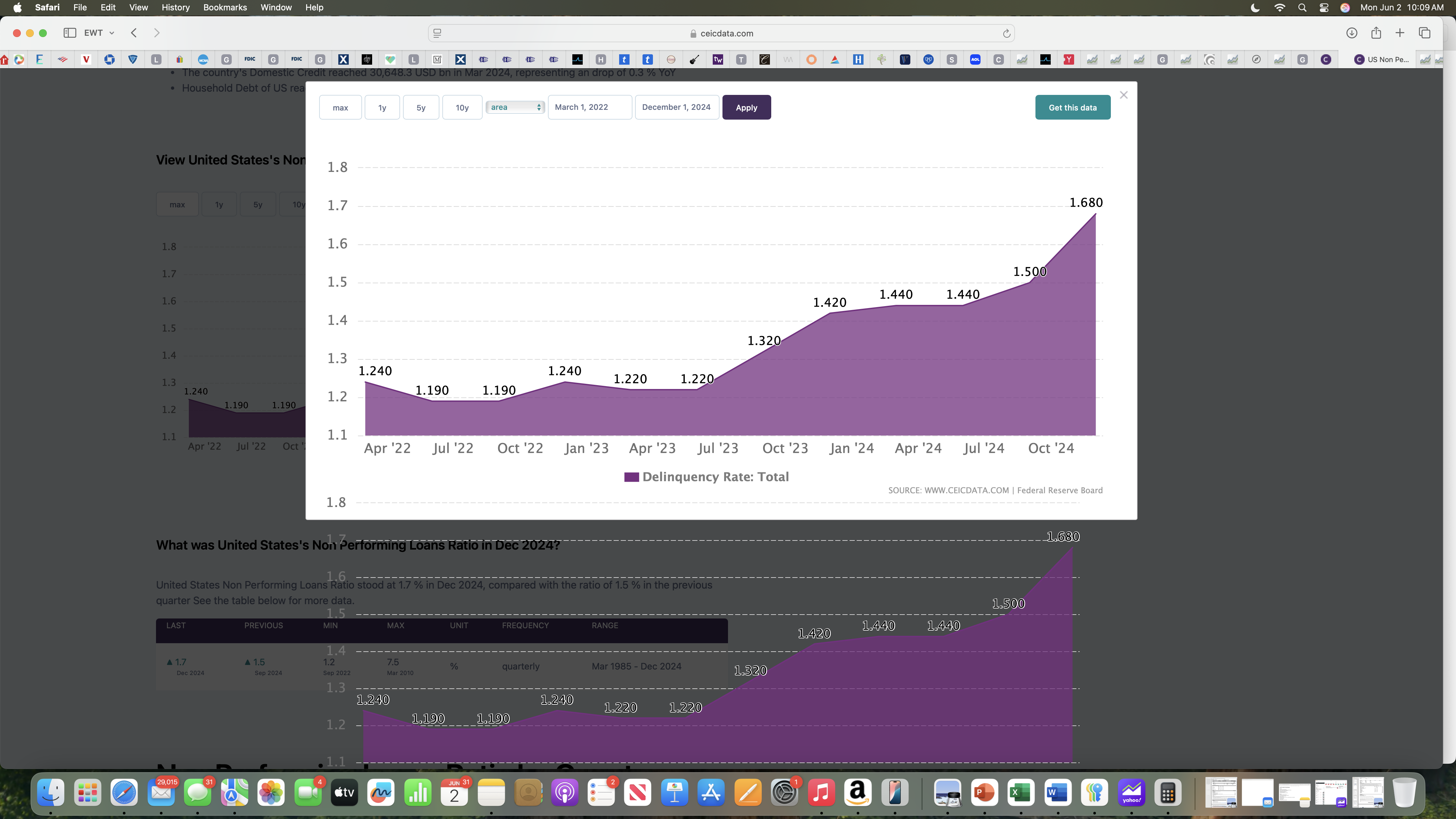

Non-Performing Loans as a percent of total loans has increased by 38% since mid-2023

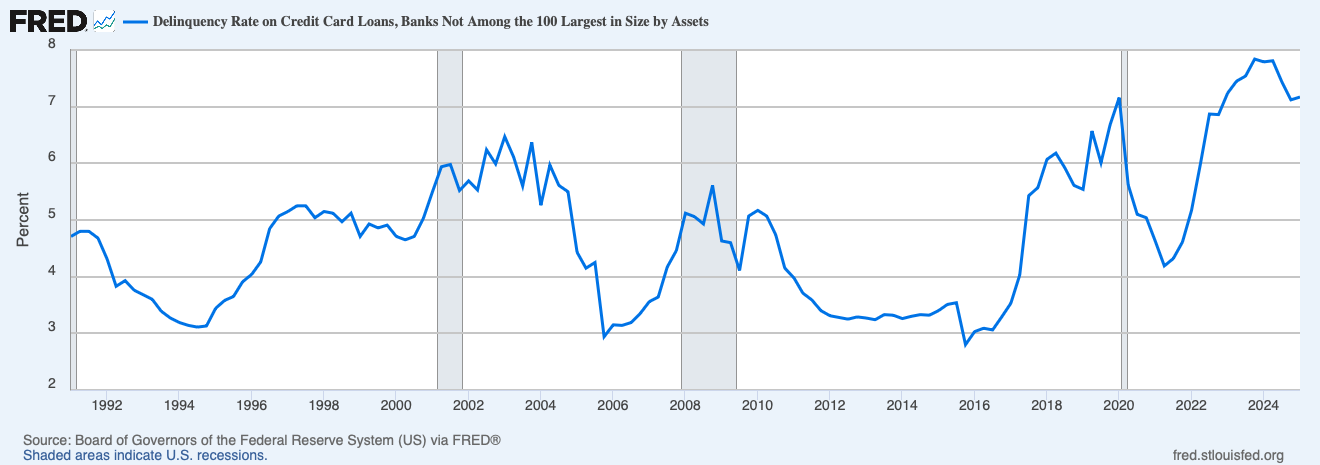

Credit Card Delinquencies have been increasing

Delinquencies for both small and large banks have been increasing since 2020

Small Banks

Large Banks

Net Interest Margin has been declining Since 2010

- Net Interest Margin is a measure of profitability on loans and other earning assets

- Federal Reserve data is only available through 2021

In short, FDIC insured banks:

- Have seen their capital erode

- Non-performing loans rise

- Credit card delinquencies rise, and

- Their profit margin on loans and other assets decline

This is a warning sign, telling us that the strength of our banking system has been weakening and is likely on the verge of another crisis.

History seems to be rhyming again.

Let’s take a look at what actually took place in 2008-10 and the events of the prior decade.

As hard as it may be to believe, in the mid-90’s the FDIC concluded that “well capitalized” banks no longer needed to contribute to the insurance pool. The Deposit Insurance Funds Act of 1996 mandated that "well-capitalized" banks with top supervisory ratings, which included most banks, be assessed fees at zero, effectively eliminating fees for them from 1997 to 2006. The average deposit insurance fee dropped dramatically during this period. However, fees were still charged to banks that were not "well-capitalized.”

As a result, the FDIC Deposit Insurance Fund (DIF) was unable to cover all of the losses incurred during the Great Recession. The DIF eroded from a balance of $52.4 Billion in 2007 to a balance of -$20.9 Billion in 2009…. A loss of $73.3 Billion during that 2-year period. These losses were covered by taxpayers via multiple U.S. Government bailouts.

In 2011, the FDIC adopted a rule that finalized new rates charged to all banks, beginning on April 1, 2011. As the Head of Deposit and Liquidity Management for a Top 5 bank, I was responsible for implementing this and other regulatory changes that were outgrowths of the Great Recession. Several of these changes were recommended to the FDIC Resolutions Division in 2006-2007 as part of a consulting engagement I managed.

DIF Reserve Requirement

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 set the required minimum reserve ratio to 1.35 percent. The reserve ratio is defined as the percent of aggregate insured deposits that need to be held in the Deposit Insurance Fund. If the reserve ratio falls below 1.35 percent or is expected to within 6 months, the FDIC generally must adopt a restoration plan to restore the DIF reserve ratio to at least 1.35 percent within 8 years.

Separate from the Dodd-Frank minimum requirement, the FDIC Board of Directors sets an annual Deposit Reserve Ratio, or DRR, at the beginning of each calendar year. The DRR has been set at 2.00% since 2011. As of March 31, 2025 the DRR stood at 1.25%, below both the Dodd-Frank mandated minimum of 1.35% and the FDIC Board’s stated minimum for 2025 of 2.00%.

The current Reserve of 1.25% is 60% below the

minimum threshold set by the FDIC Board coming into 2025.

This would seem to be inconsistent with The FDIC’s stated objective of “make large and complex financial institutions resolvable and manage receiverships”, as well as “to maintain stability and public confidence in the nation's financial system.”

Will the FDIC be able to cover the next banking bailout?

Let’s review the key facts:

- The FDIC is responsible for:

- Examining and supervising financial institutions for safety, soundness, and consumer protection

- Making large and complex financial institutions resolvable and managing receiverships

- Maintaining stability and public confidence in the nation's financial system. And

- Maintaining a Deposit Insurance Fund adequate in size to cover insured deposits in the event of a rash or bank failures

- The Deposit Insurance Fund was unable to fully cover insured deposits during the Savings and Loan crisis of the late 1980’s

- The Deposit Insurance Fund was unable to fully cover insured deposits during the Great Recession of 2008-10

- Insured deposits left uncovered by the FDIC were covered by taxpayers through massive government bailouts

- The Deposit Insurance Fund is currently 60 percent short of the FDIC Board’s self-imposed Deposit Reserve Requirement of 2.00 percent, and

- The financial condition of FDIC insured Financial Institutions has been declining

Mark Twain said it best…. “History doesn’t repeat itself, but it often rhymes”.

Safer Banking Research Summation

I want to thank Mr. Avers for providing us with his expertise and understanding of the FDIC and where he sees our issues in the future. For those following our work through the years, none of this should be any surprise to you. In fact, we have warned many times that you should not even consider the FDIC insurance in your risk management plans when it comes to where to store your hard-earned money in the future for the very reasons outlined by Mr. Avers.

In fact, as we have also written in the past, there will not likely be any further bail-outs of the banking system, as the world is likely going to head down the path of “bail-ins.” And, if you do not know what a “bail-in” is, I strongly urge you to read our other articles discussing this new path that depositors of failed banks will likely face. So, to maintain an expectation that the US Government is going to stand behind the next financial crisis (which will likely be more akin to that of the Great Depression in size) is nothing less than being absolutely reckless with your heard-earned money.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Consider that there was one major issue which caused the GFC back in 2008, whereas today we currently have many more large issues on bank balance sheets.

These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what led to the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail before that occurred. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to review and utilize our due diligence methodology here.