The Fed Is About To Put Your Money At Greater Risk

See our latest article on bank safety, titled "The Fed Is About To Put Your Money At Greater Risk."

Last week, the media reported that U.S. banking regulators were expected to significantly reduce capital requirements for banks with assets over $100B under the so-called “Basel III endgame proposal." According to Reuters, “the biggest capital savings will come from changes to how banks will have to calculate potential losses from operational risks." In addition, regulators will likely scrap or reduce higher risk-weights on mortgages for low-income borrowers.

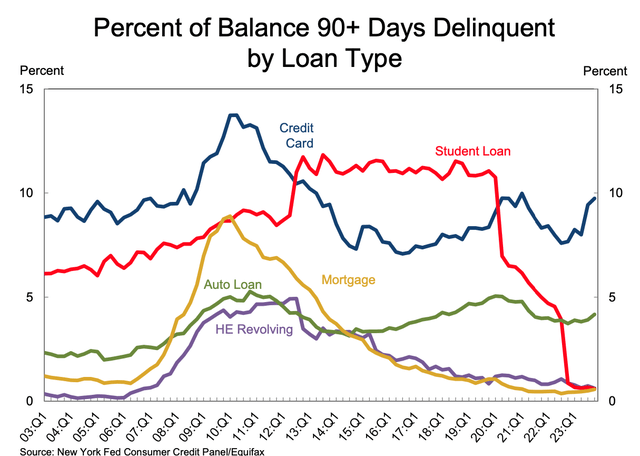

For everyone who is following our banking articles and is aware of the current stage of the credit cycle in the U.S., this should come as a big surprise. Credit quality metrics of most lending products in the system are deteriorating quite rapidly, and, as Banking 101 tells us, a banking regulator should impose stricter capital requirements to make sure that banks have enough capital to absorb losses from expected asset quality issues – not loosen them.

In this article, we’d like to share our thoughts on why the Fed has decided to make such an unexpected move.

First, it appears that quite a lot of banks with assets over $100B simply cannot meet the initial stricter capital requirements. This implies that a lot of statements from the Fed’s officials about "a well-capitalized banking system" were too optimistic, to put it mildly. The past 15 years were a relatively benign period for the largest U.S. banks, especially when compared to their European and Asian peers. However, it looks like most of them failed to build a necessary capital cushion.

Second, the initial capital requirements, which were proposed by the Fed last summer, triggered some significant changes in the balance sheets of the largest banks. The banks started to find quick and easy ways to lower their RWAs (risk-weighted assets).

For starters, RWAs determine how much capital a bank must hold. Securitization became one of the easiest ways to lower RWAs. For example, U.S. Bancorp (USB) announced plans to issue $2.5B of auto CLNs (credit-linked motes). These CLNs became quite a popular product as they allow banks to transfer credit risk from their balance sheets to another entity, usually to a financial company such as a hedge fund or an asset manager. This looked good initially, but hedge funds and asset managers needed money to purchase those CLNs, and they started to borrow from the largest U.S. banks. In our view, this is what caused such a sharp spike in lending to shadow banking intermediaries, which we discussed in one of our previous articles. Loans to shadow banking intermediaries have recently surpassed the $1T mark, of which almost 70% were granted by the Top-25 largest U.S. banks. In other words, large banks are transferring credit risks of prime loans, and, at the same time, are granting loans to high-risk low-quality shadow banking intermediaries.

In addition, in order to reduce RWAs, the largest banks have been buying CLOs (collateralized loan obligations), which we also discussed in our previous article. Those securities have lower risk-weights than majority of loan products. JPMorgan (JPM), Wells Fargo (WFC), and Citi (C) hold $120B of CLOs on their balance sheets. These CLOs are backed by loans granted mostly to corporations with low credit rating, venture capital funds, and private equity firms. The total amount of the CLOs market is estimated at $1 trillion.

We believe the Fed is seeing both trends, and they're among the reasons for new proposals. However, those issues with CLNs and CLOs should have been dealt with much earlier by raising the risk-weight on these instruments.

Other very concerning news is that, according to Reuters, the Fed is going to scrap or reduce higher risk-weights on mortgages to low-income borrowers. As the chart below shows, residential mortgages are currently one of the best-performing retail lending products in terms of credit quality. This is largely due to the fact that they were the reason for the Great Recession, and, as a result, have been strictly regulated since.

FDIC

However, if the Fed scraps higher risk-weights on mortgages to low-income borrowers for the largest banks, that could catalyze a new subprime crisis.

Bottom Line

If you still think that the largest banks will be the safest place to park your money in a systemic crisis scenario, despite all our previous articles, here's another issue of which you must be aware. Given that the Fed wants to significantly reduce their capital requirements, it seems that banks with assets of more than $100B are in much worse shape than regulators had claimed them to be.

I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, details for which are here.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail, well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to use our due diligence methodology outlined here.