The Fed Action Is Not Helping The Banks

Latest article on bank safety by Avi Gilburt and Renaissance Research

The Fed Action Is Not Helping The Banks

Over the past week, there have been quite a few media reports and comments from research agencies that U.S. banks should benefit from the Fed’s 50 bps rate cut. Several pundits said this rate cut should alleviate pressure on the banks’ credit quality, particularly in credit cards and the CRE sector.

As we have said many times, in this difficult environment, you should take most stories from the financial media, analytical reports, or even articles by independent analysts with a very large grain of salt. A lot of the conclusions from these reports are incorrect and not supported by the public data.

Moreover, the banking regulators are apparently under significant pressure from the very powerful banking lobby. We have published a detailed article about an unprecedented lobbying campaign, which, according to reports, was launched by large banks against higher capital requirements.

In this article, we will discuss how the recent rate cut will affect the U.S. banking sector, and it's not as most would think.

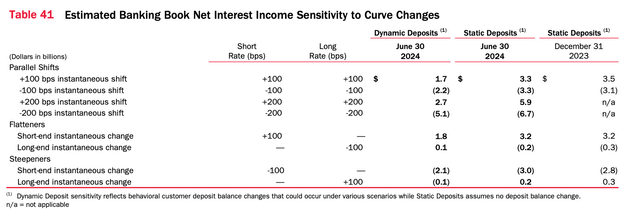

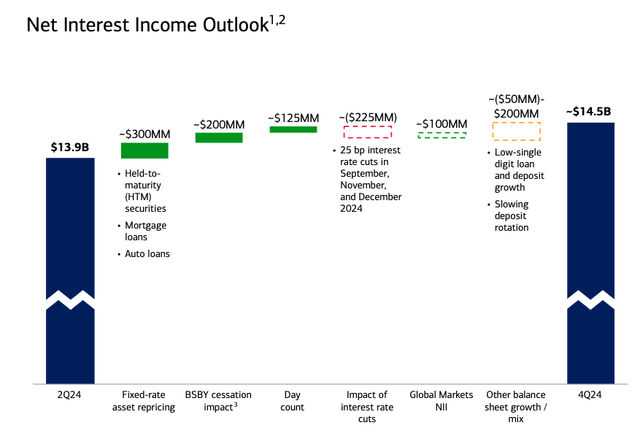

First and foremost, the majority of U.S. banks have asset-sensitive balance sheets, implying that their assets reprice more quickly than their liabilities. In other words, lower policy rates decrease the net interest income (NII) of the banks. For example, here's what Bank of America (BAC) discloses regarding its NII sensitivity to rate changes.

Company Data

Company Data

As you can see, lower policy rates are negative for BAC’s NII as well as for more than 90% of U.S. banks.

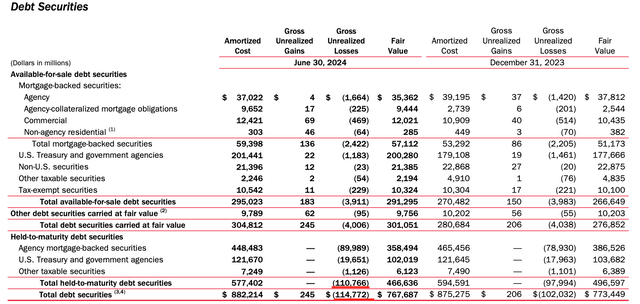

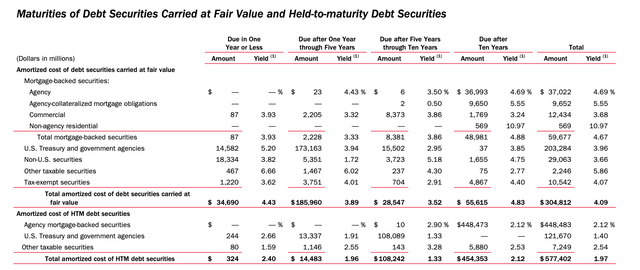

Some experts said that lower policy rates should decrease unrealized losses on held-to-maturity and available-for-sale securities portfolios. According to the FDIC, these losses for the sector were $512.9B as of the end of the second quarter. We will look at BAC again as the bank accounts for more than 20% of these losses.

Company Data

As you can see from the table below, the majority of BAC’s HTM securities have a maturity of more than 10 years, and the average yield of the bank’s HTM portfolio is less than 2%, suggesting that even after the 50 bps cut, BAC still has big unrealized losses from securities.

Company Data

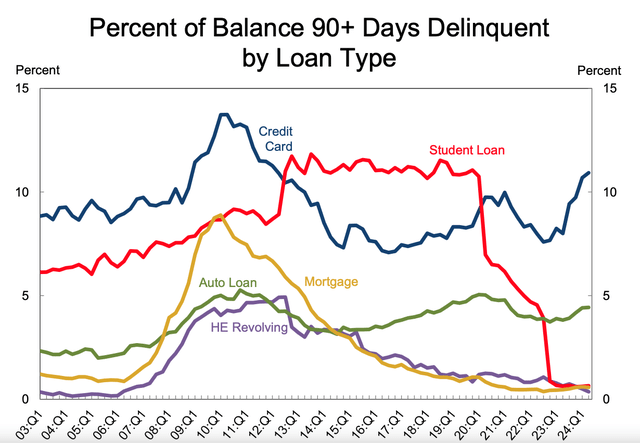

Some experts said that the 50 bps cut will improve asset quality issues with credit cards. According to Forbes, the average overall APR across credit cards is 27.92%. In our view, it's very naive to think that the 50 bps rate cut will improve the asset quality of this segment when rates are as high as 28%. In addition, as shown below, the share of delinquent credit cards continue to increase at a very high rate.

NY Fed

Finally, even the FDIC, which is almost always very optimistic, concluded the following (the emphasis is ours):

In 2024, tighter liquidity positions and higher reliance on wholesale funding will increase funding risk for some banks should market stress or rapid changes in market conditions occur. Even if market interest rates decline in 2024, banks with low liquidity positions, higher unrealized securities losses, insufficient access to off-balance-sheet secured borrowing lines, or volatility in deposit retention may continue to experience heightened liquidity pressure.

Bottom line

Believe it or not, there are more major issues on larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking lending has exploded. So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks, including those noted above, in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written. And, as these issues get worse, the risk continues to rise.

Moreover, if you believe that the banking issues have been addressed, I think that more recent issues surrounding New York Community Bancorp (NYCB) is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, one of the main reasons being the banking industry's desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive into the banks that house your hard-earned money to determine whether your bank is truly solid or not. Review our due diligence methodology here.