Student Loans Are Yet Another Rising Risk For Banks – As If They Needed More

Our latest article on bank safety: Student Loans Are Yet Another Rising Risk For Banks – As If They Needed More

Several months ago, we published an article on student loans. Recall that the first wave of past-due balances appeared in 1Q25—a direct result of policy shifts. Federal student-loan payments were paused for 43 months beginning in March 2020, pushing delinquencies below 1%. When repayments resumed in September 2023, a one-year “on-ramp” kept missed payments off credit reports. That protection expired in October 2024, and delinquencies began to show up in the 1Q25 data.

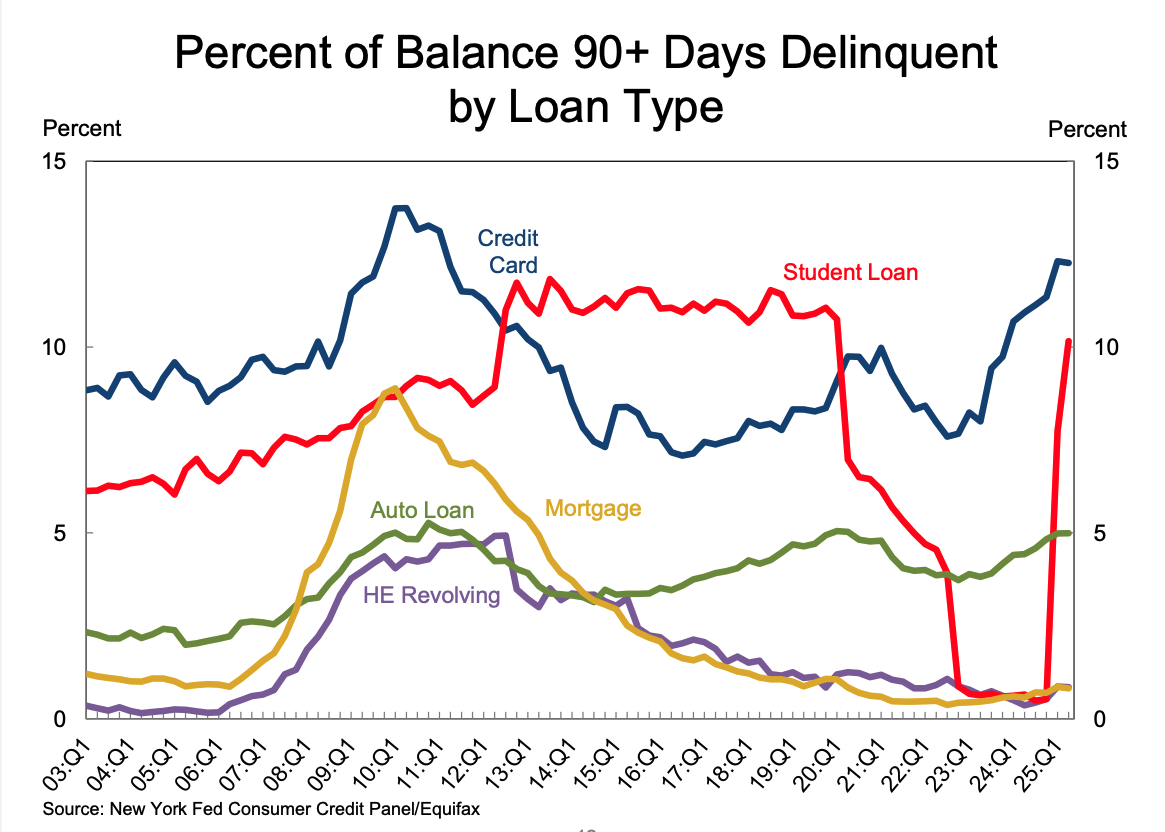

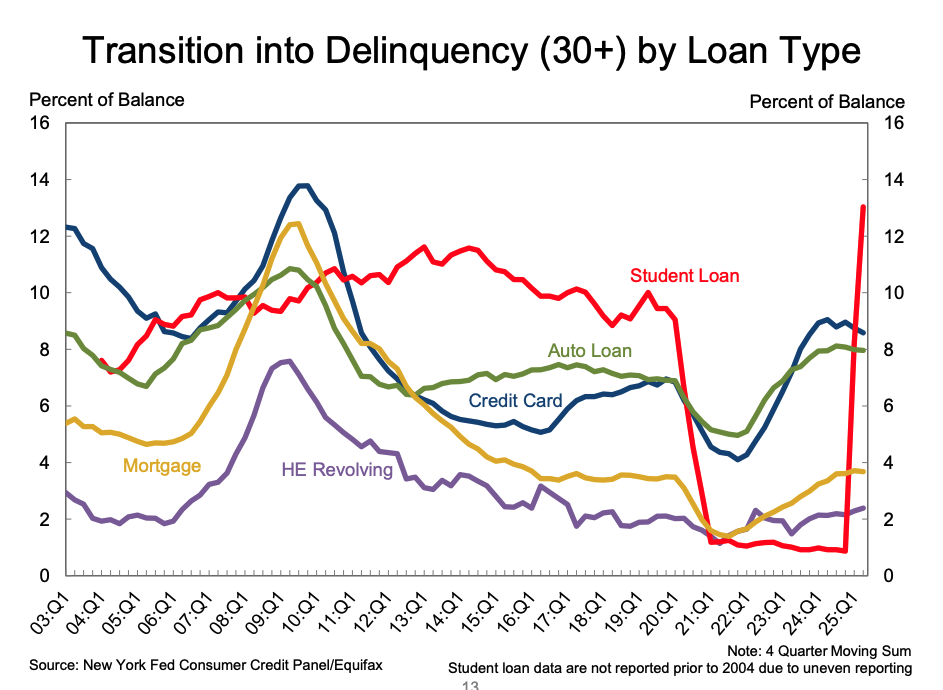

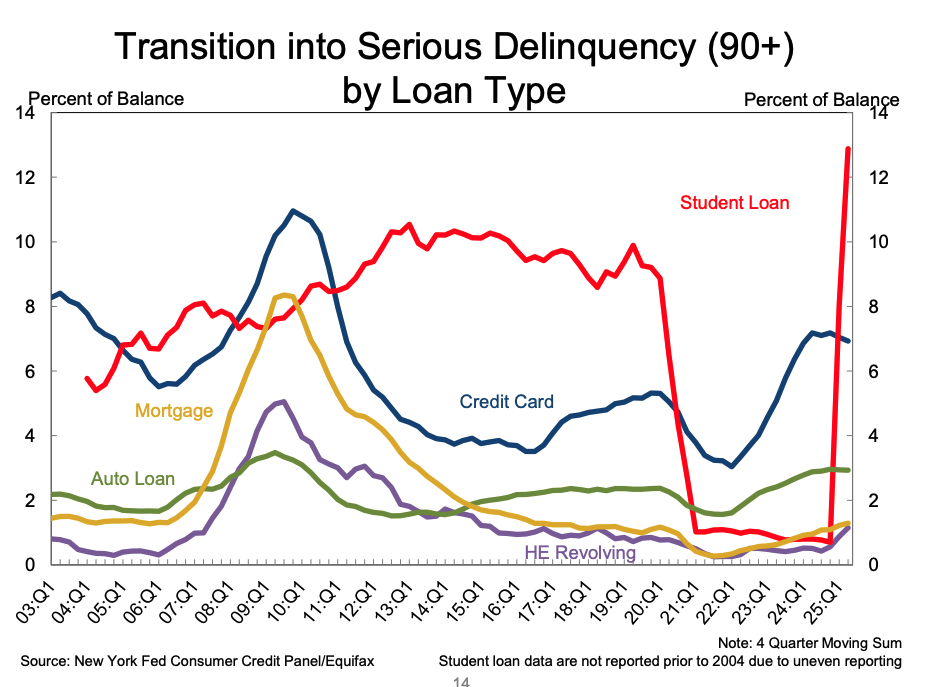

We noted then that 1Q25 would be only the initial batch, with further increases likely in subsequent quarters. The NY Fed’s 2Q25 Consumer Debt Report, released recently, confirms that view: more than 10% of student loans were 90+ days delinquent at quarter-end. Meanwhile, the shares of seriously delinquent credit-card and auto loans are just below their GFC peaks. We have covered credit cards and auto loans in prior articles, as these categories pose significant issues for large U.S. banks.

Alongside credit-card and auto loans, student loans have become another pressure point for consumer lending. With total student debt near $2T—roughly 80% of the banking system’s aggregate equity—this poses a potential systemic risk.

Another serious concern: transition rates into delinquency (both 30+ and 90+ days) are already well above their GFC peaks, as the charts below show.

Importantly, student loans remain an outlier because many borrowers cannot be classified as delinquent. As the NY Fed notes, more than 20 million federal borrowers were not in repayment at quarter-end (due to deferment, forbearance, or current enrollment), while another ~5 million had zero monthly payments under income-driven plans. The real stress lies with those required to pay: among this group, nearly one in four (23.7%) were delinquent on their student loans. That implies the current ~10% overall delinquency rate is only a starting point. In that context, the GFC peak of ~12% may prove a very low bar.

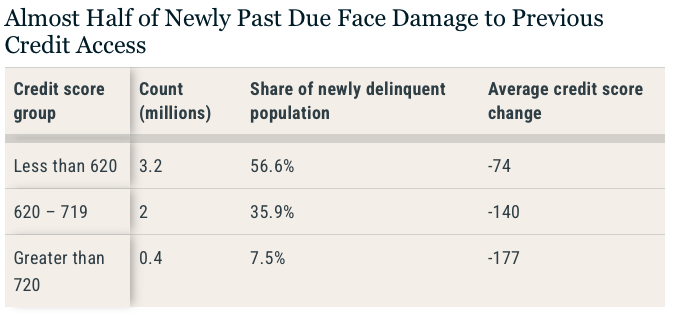

Critically, the fallout extends far beyond specialized student-loan lenders. As delinquencies now feed into credit reports, roughly 6 million borrowers will see sharp declines in credit scores. This will constrain access to mortgages, credit cards, and auto loans, amplifying pressure across the broader consumer-credit landscape.

Source: NY Fed

This means nearly 6 million borrowers will now face either:

- Sharply higher borrowing costs for other consumer debt (credit cards, auto loans, mortgages), or

- Complete denial of new credit.

In the first scenario, elevated borrowing costs will likely accelerate debt distress – increasing default risks and ultimately generating larger credit losses for banks. In the second scenario, credit denial directly reduces consumer spending, dampening economic activity. This weaker economic environment would then compound pressure on borrowers, eventually driving larger credit losses across the banking system.

These dynamics confirm our very cautious stance toward banks with significant consumer-debt exposure. As outlined in our initial methodology, when we attempt to identify the strongest banks, we exclude institutions with high concentrations of unsecured consumer lending.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, high-risk shadow banking (the lending for which has exploded), and elevated default risk in commercial and industrial (C&I) lending. So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. You can feel free to review our due diligence methodology here.