Protect Yourself Now - Banks Are Just Beginning To Fall Apart

The recent collapses of Tricolor Holdings, a car dealership, and First Brands, an auto parts company, have triggered a wave of reactions and speculation among mainstream media, analysts, and investors. Many in the investor community appear to have suddenly recognized the extremely high risks embedded in the shadow-banking industry. They also seemed surprised that the largest banks were lending to these companies: JPMorgan and Fifth Third were hit by the Tricolor failure, while First Brands affected Jefferies and UBS, due to their unsecured loan.

If you follow our banking work, these issues would not be surprising you today, as we have been extensively highlighting risks associated with the shadow-banking industry. We have argued that, given the lack of regulation, opacity, and high-risk business models of shadow lenders, it was only a matter of time before we saw major deterioration in the industry. That said, judging by the media coverage, the collapses of Tricolor and First Brands seem to have come as a surprise to most others.

Interestingly, the IMF recently published a report asserting that traditional banks’ significant exposures to shadow lenders are among the most material risks to global financial stability. And, I suggest you read that again.

According to the IMF, global banks’ exposure to shadow lenders is about $4.5 trillion. While the IMF did not provide figures for U.S. banks alone, last year the Fed said U.S. banks had extended almost $3 trillion to shadow lenders. Given the industry’s rapid growth, the current portfolio is likely closer to $3.5 trillion - significantly above the banking system’s total equity of roughly $2.5 trillion. In addition, off-balance-sheet exposure is hard to estimate, but based on some estimates we discussed in previous articles, total exposure could be around $5 trillion. In other words, there is strong potential now for total exposure to the banking industry for just the shadow banking issue alone to be double the banking systems total equity! And, if you have already forgotten, there are 5 other major issues sitting on bank balance sheets in addition to the shadow banking issue.

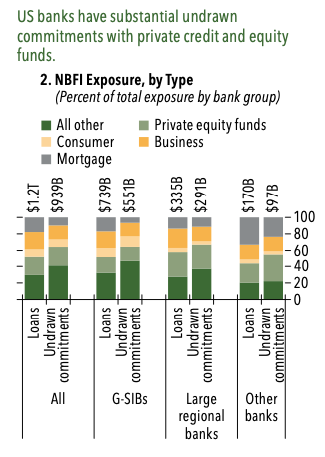

The IMF report also highlights that shadow-banking exposures are concentrated at the largest banks, which have granted roughly 90% of loans to shadow lenders. Moreover, unlike European banks, U.S. banks maintain substantial undrawn commitments, as the chart below shows.

Source: IMF

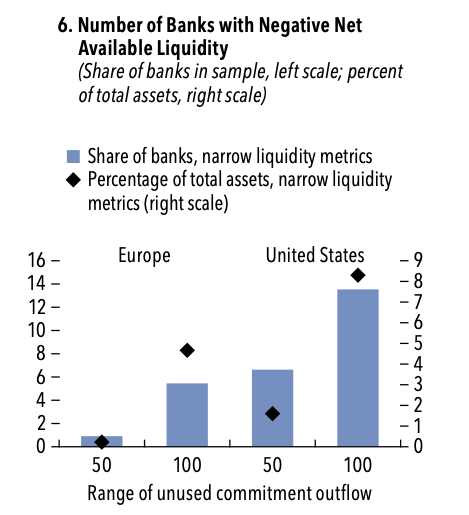

Such large undrawn commitments have left several U.S. banks with negative net available liquidity - a key factor in bank failures. Again, the IMF is referring to the largest U.S. banks.

Source: IMF

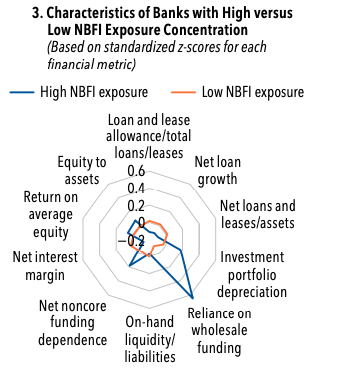

Another takeaway from the IMF’s work is that U.S. banks with high concentrations of exposure shadow lenders tend to rely more on wholesale funding. As we discussed earlier, reliance on wholesale funding is another key reason banks fail and is one of the key red flags in our methodology. Clearly, the combination of high exposure to shadow lenders and heavy reliance on wholesale funding creates an extremely high risk for the largest U.S. banks.

Source: IMF

Notably, the IMF clearly states that the explosive growth in lending to shadow banks was driven by the very high returns on these loans and by lax regulation that require only minimal capital to be held against them.

This problem could have been addressed five years ago, when lending to shadow banks began to surge. Regulators should have implemented higher risk weights for such lending. In other words, if a bank wants to extend credit to a high-risk borrower like a shadow lender, it should have been required to hold more capital against that loan. Yet, for various reasons, that did not happen. Now regulators have limited tools to manage risks in the shadow-banking system, as banks’ loan exposure to the sector already well exceeds the sector’s capital base. This is a very dangerous situation that has now developed.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, high-risk shadow banking (the lending for which has exploded), and elevated default risk in commercial and industrial (C&I) lending. So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. You can feel free to review our due diligence methodology here.