OTC Derivatives Are Presenting Huge Tail-Risk To JPMorgan

Our latest article on bank safety, titled "OTC Derivatives Are Presenting Huge Tail-Risk To JPMorgan."

A couple of weeks ago, Moody's cut its rating outlook to negative from stable on JPMorgan (JPM), Bank of America (BAC), and Wells Fargo (WFC). According to the agency, this downgrade was due to "the potentially weaker capacity of the U.S. government to support the U.S.'s systemically important banks". In addition, the agency noted that JPMorgan's downgrade was "partially because the bank runs a complex capital markets business that may pose substantial risks to its creditors."

If you read our previous articles on large banks and the U.S. banking system, that should not come as a surprise to you. You will probably notice that this Moody's report came out with a significant time lag relative to our analysis, as we have been discussing the issues to which Moody's is referring for the past 18 months.

In August 2022, we published an article on JPM, in which we mentioned that while this bank is a well-run institution and is one of the better banks among U.S. large lenders, it has quite a lot of red flags, which are likely to lead to major issues for depositors in a systemic crisis scenario. Our biggest concern was that JPM has a huge position in derivatives, in particular the so-called OTC (over-the-counter) derivatives. We assume that when Moody's says that JPM "has a complex capital markets business", the agency is referring to this specific issue.

For starters, we would like to highlight a note on the difference between OTC, cleared, and exchanged derivatives, which Citigroup (C) has made in its 10-K, as it is relevant for JPM as well:

"Over-the-counter (OTC) derivatives are derivatives executed and settled bilaterally with counterparties without the use of an organized exchange or central clearing house.

Cleared derivatives include derivatives executed bilaterally with a counterparty in the OTC market but then novated to a central clearing house, whereby the central clearing house becomes the counterparty to both of the original counterparties.

Exchange-traded derivatives include derivatives executed directly on an organized exchange that provides pre-trade price transparency."

It should come as no surprise that OTC contracts are the riskiest type of derivatives, especially in a recessionary environment when there is a high chance of a counterparty default risk.

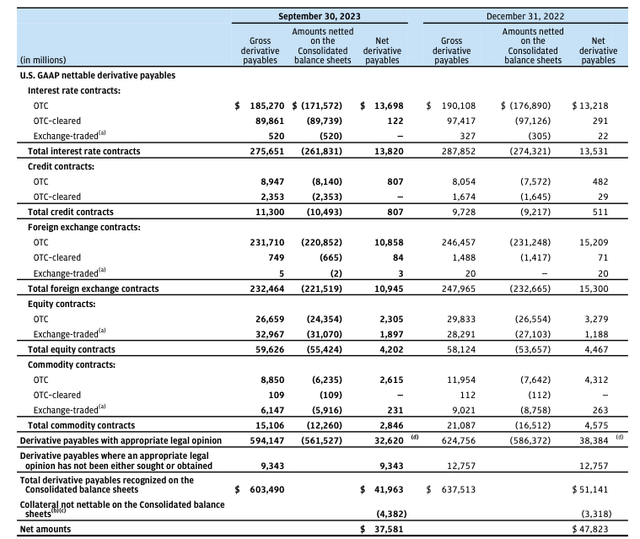

Here is the data on JPM's derivatives from its latest 10-Q.

Company Data

As the table shows, JPM had $603B in total gross derivate payables as of the end of 3Q, of which around 76% were OTC derivatives. In addition, there are tens of trillions of derivatives on the bank's off-balance sheet.

This significant risk associated with OTC derivatives was once again brought to light in March, when Credit Suisse was on the brink of collapse. As a reminder, in March, Credit Suisse published its 2022 annual report, in which it mentioned that it had identified a material weakness in its reporting procedures that could result in misstatement risks. After this report, quite a lot of large banks restricted trades with CS. Moreover, many banks reportedly stopped accepting requests to take over their derivatives contracts when CS was the counterparty. In other words, derivatives contracts, in which CS was acting as one of the counterparties, became void.

Make no mistake, an OTC-derivative counterparty default risk is not a theoretical tail-risk event, which is discussed only in academic papers. It is a real risk, and, in fact, U.S. banks are warning their clients of that risk in the SEC filings. Moreover, even tail-risk events sometimes occur. For example, such an event has recently occurred with the Fed's losses, and we discussed that in one of our articles.

Bottom line

As we often say, rating agencies and research departments of large banks are always the last to know. In our view, depositors should not rely on their ratings when choosing a bank for their savings, as their rating actions and comments come out with a significant time lag, and it may be too late for depositors.

In this article, we discussed JPMorgan. But if you follow our work on banking, you have probably noticed that we have published quite a lot of articles on Bank of America and Wells Fargo, warning our readers of the problems that these banks have.

I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, details for which are here.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail, well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Our due diligence methodology is outlined here.