Liquidity Is Still An Issue For Our Banks

Here's our latest article on bank safety: "Liquidity Is Still An Issue For Our Banks."

As part of our ongoing series of articles on bank stability, and at the request of many of our clients, we wanted to address the major risks we foresee for bank stability in the coming years.

But before we begin, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, details for which are here.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

If you follow mainstream financial media, you have probably noticed that most of them are saying that the liquidity crisis in the U.S. banking system has ended and is unlikely to repeat. In fact, Jerome Powell just that "banks are generally well capitalized and highly liquid in our country".

However, a deeper look at the latest sector data published by the FDIC suggests that the liquidity position in the country's banking system remains challenging, and a potential sharp increase in policy rates could very likely lead to major issues and bank failures.

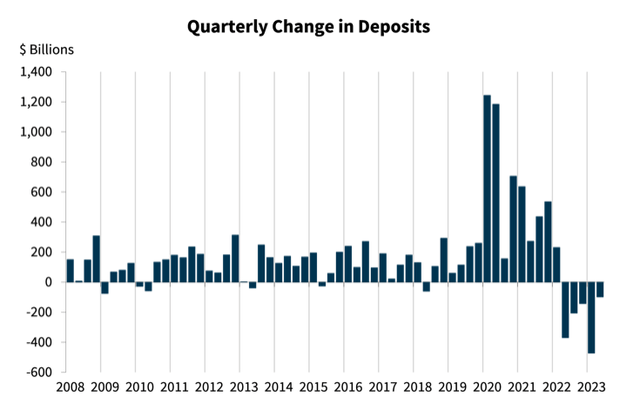

First of all, it is worth noting that bank deposits fell for a fifth consecutive quarter in Q2.

FDIC

Total deposits were $18.6T in the second quarter, down 0.5% QoQ. Notably, the so-called U.S. GSIBs (global systemic important banks) reported a larger decline as their deposits fell by 1.2% QoQ. As a reminder, there are 8 GSIBs in the U.S.: Bank of America, Bank of New York Mellon, Citigroup, Goldman Sachs, JPMorgan, Morgan Stanley, State Street, and Wells Fargo.

There has been a lot of talk about how, as a result of the SVB failure, deposits flow from smaller regional and community banks to the largest banks. However, the data shows that this is a misconception. In addition, uninsured deposits at the GSIBs fell by 3% QoQ, suggesting that clients do not believe that the GSIBs status would protect their savings if a major crisis comes. The FDIC is also saying that the "huge deposit inflows into GSIBs" narrative appeared to be a misconception:

"There has been a great deal of discussion about deposit flows between the nation's larger banks, primarily under the assumption that deposits have flowed from regional banks to the largest banks. While deposit balances may have suggested that such flows occurred on a limited basis toward the end of the first quarter, that does not appear to have been the case in the second quarter. The nation's global systemically important banks reported a 1.2 percent quarterly decline in total deposits in the second quarter, primarily driven by a 3 percent decline in uninsured deposit"

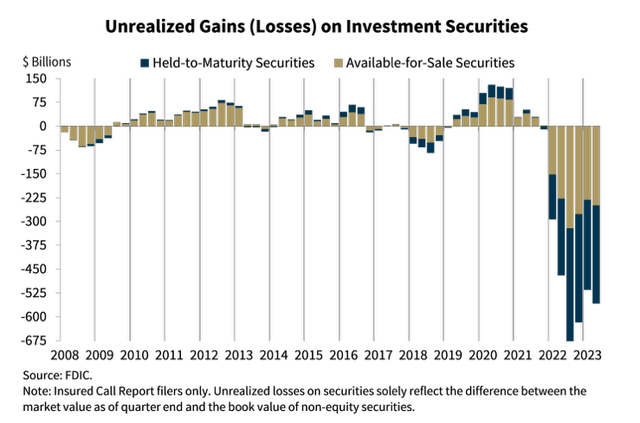

Second, there is still that issue with the elevated level of unrealized losses on available-for-sale and held-to-maturity securities. Moreover, these losses increased by 8.3% QoQ in Q2 and reached $558.4B.

FDIC

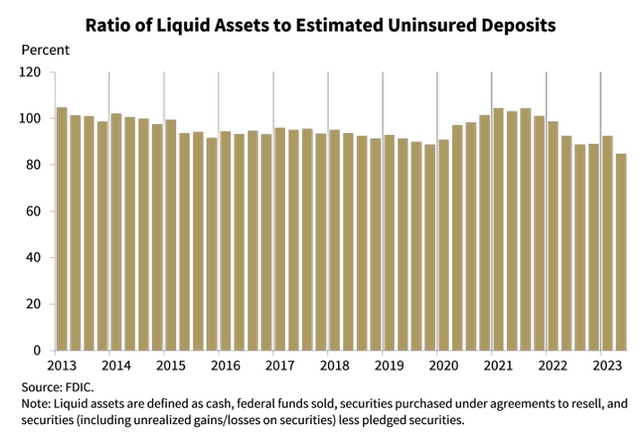

Another indicator that looks quite concerning is the ratio of liquid assets to estimated insured deposits. The metric fell to 84.7%, which is the lowest data point on the chart below. It is important to note that investment securities are part of liquid assets, but banks can sell them only at a huge loss. If we subtract securities from liquid assets, then the ratio of liquid assets to insured deposits would be much lower.

FDIC

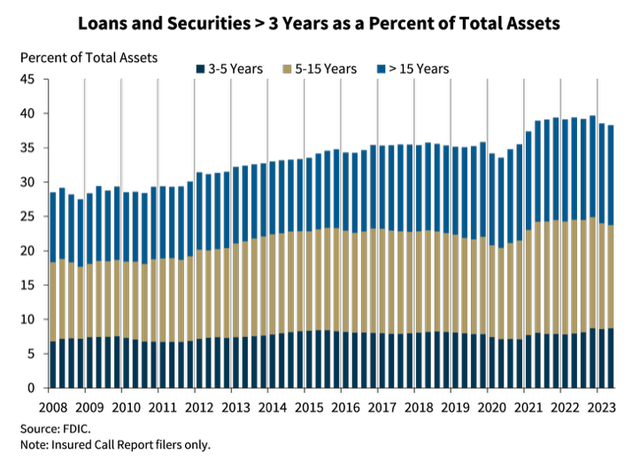

We have been discussing maturity mismatch risk in the industry for more than 18 months, and this risk still remains in the system. The chart below shows that loans and securities with maturities of more than 3 years reached 38.3% of the sector's total assets, and the majority of them are loans and securities with maturities of more than 5 years. Obviously, these assets are very sensitive to higher interest rates. On the other side of the balance sheet, banks mostly have short-term deposits.

FDIC

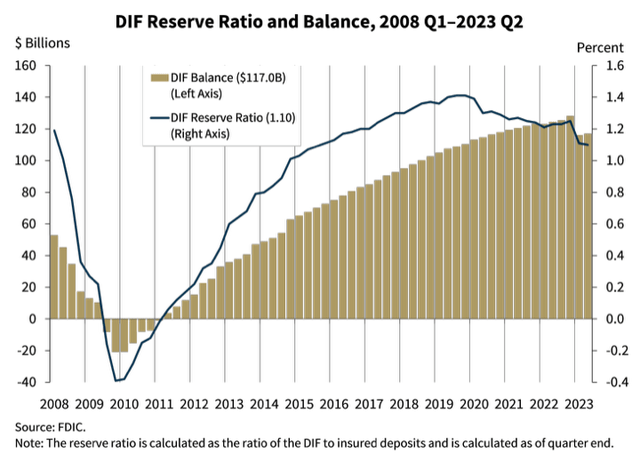

Finally, for all those who think that the DIF (Deposit Insurance Fund) will protect their savings, we want to show the following chart:

FDIC

The DIF reserve ratio, which is calculated as the amount of the DIF divided by insured deposits, is just 1.1%. In other words, the DIF covers only 1.1% of all insured deposits in the banking system.

Bottom line

Make no mistake, the liquidity crisis in the U.S. is far from over. Moreover, if rates go higher from here, the situation will likely deteriorate significantly. The data we have discussed in this article shows that most U.S. banks are completely unprepared for this scenario from a liquidity perspective.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to use our due diligence methodology, outlined here.