Is Your Bank Safe? A Look At Goldman Sachs

The next article in our "Is Your Bank Safe?" series on Seeking Alpha -- this one on Goldman Sachs -- is now available. You can see the full article below.

Throughout 2022, we have written several articles outlining our views of banks in general. We explained the relationship that you, as a depositor, have with your bank is in line with a debtor/creditor relationship. This places you in a precarious position should the bank encounter financial or liquidity issues. Moreover, we also outlined why reliance on the FDIC may not be wholly advisable. And, finally, we explained that the next time there's a financial meltdown, your deposits may be turned into equity to assist the bank in reorganizing.

So, at the end of the day, it behooves you, as a depositor, to seek out the strongest banks you can find, and to avoid banks which have questionable stability.

While we outlined in our last articles the potential pitfalls we foresee with regard to various banks in the foreseeable future, we have not provided you with a deeper understanding as to why we see the larger banks as having questionable stability. Over the coming months, we intend to publish articles outlining our views on this matter.

First, we want to explain the process with which we review the stability of a bank.

We focus on four main categories which are crucial to any bank's operating performance. These are: 1) Balance Sheet Strength; 2) Margins & Cost Efficiency; 3) Asset Quality; 4) Capital & Profitability. Each of these four categories is divided into five subcategories, and then a score ranging from 1-5 is assigned for each of these 20 sub-categories:

If a bank looks much better than the peer group in the sub-category, it receives a score of 5.

If a bank looks better than the peer group in the sub-category, it receives a score of 4.

If a bank looks in-line with the peer group in the sub-category, it receives a score of 3.

If a bank looks worse than the peer group in the sub-category, it receives a score of 2.

If a bank looks much worse than the peer group in the sub-category, it receives a score of 1.

Afterwards, we add up all the scores to get our total rating score. To make our analysis objective and straightforward, all the scores are equally weighted. As a result, an ideal bank gets 100 points, an average one 60 points, and a bad one 20 points.

If you would like to read more detail on our process for evaluating a bank, feel free to read it here.

But, there are also certain "gate-keeping" issues which a bank must overcome before we even score that particular bank. And, many banks present "red flags," which cause us to shy away from even considering them in our ranking system.

As mentioned before, it's difficult to overestimate the importance of a deeper analysis when it comes to choosing a really strong and safe bank. There are quite a lot of red flags to which many retail depositors may not pay attention, especially in a stable market environment. However, those red flags are likely to lead to major issues in a volatile environment. Below we highlight some of the key issues that we are currently seeing when we take a closer look at Goldman Sachs.

Goldman Sachs (NYSE:GS) launched its U.S. consumer banking unit, Marcus, in 2016. Prior to that, the bank had been focusing mostly on institutional clients and market-related revenues. The key rationale behind that move to the U.S. mass retail clientele was the bank's plan to diversify both its revenue stream and funding structure.

At the time, I warned those willing to listen as to why GS was potentially going down this path:

Why Does Goldman Sachs Want Your Deposit Money?

Since its launch, Marcus has been offering attractive deposit rates for retail clients through online channels. As a result, GS currently has more than $110B of retail deposits and more than 15MM of active customers. However, despite this massive inflow of retail funding and clients, which was supposed to make the group's business model more conservative, GS remains a bank with a very volatile revenue stream and unstable funding structure.

Asset management and consumer unit of the bank are loss-making or barely profitable even in this relatively benign environment

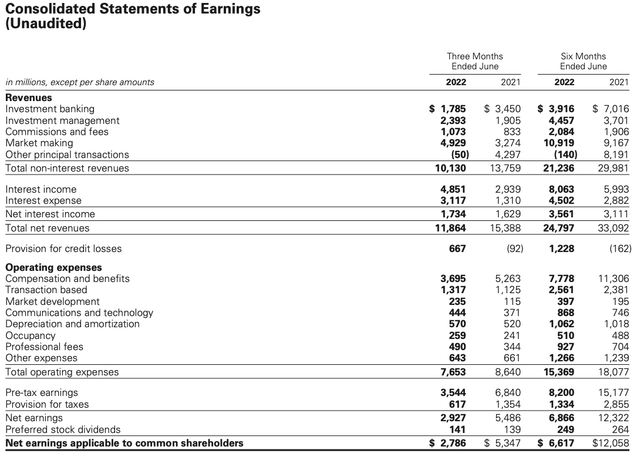

If we look at GS's consolidated P&L statement from its 10-Q report for 6M22, at a first glance, it looks good. The bank earned $6.6B of net income, which translates into a 13% ROE, which is not excellent, but it is still a good result for a large U.S. bank. As the table below shows, the bank's revenue stream looks quite diversified with exposure to investment banking, investment management, market making, and commission income.

Company Data

However, if we look at the bank's revenue breakdown by segments, it will tell us a completely different story.

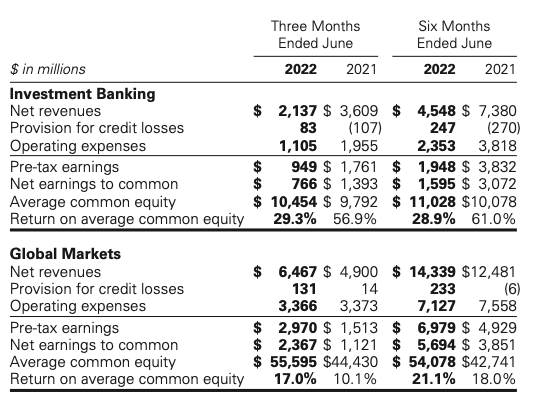

The GS Group consists of the four major business segments: Investment Banking, Global Markets, Asset Management, and Consumer & Wealth Management. Below are the financial results of Investment Banking and Global Markets segments. The profitability levels are excellent, and are much higher than that of the group.

Company Data

That being said, revenues from investment banking and global markets have been historically the most volatile ones for any global bank. Without any doubt, these revenues would be under severe pressure in a systemic crisis.

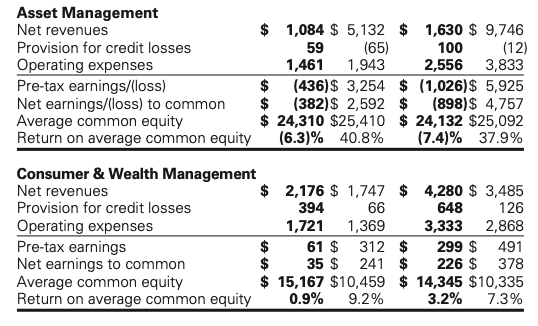

The other two units of the GS group should be less volatile and more recession-proof. However, surprisingly, even now these GS's units are either loss-making or generating a very low ROE.

The table below shows that GS's asset management unit posted a loss of $900MM for 6M22 or a -7.4% ROE. The Consumer Unit was profitable, but its ROE was just 3.2% for 6M22 and even less for 2Q22. This is extremely low for an unsecured lending business, and, just as a reminder, the current 10-year Treasuries yield is more than 4%. In other words, despite the fact that for the past six years GS has been investing heavily in its consumer unit, the segment's profitability is lower than the U.S. risk-free rate.

Importantly, the current stage of the credit cycle in the U.S. is still favorable for consumer lenders, and most of them are comfortably delivering a 15-20% ROE for their shareholders. Given that, such a poor performance of Marcus does raise eyebrows of banking experts.

Company Data

Company Data

It is also worth mentioning that the tables above show that the Global Markets and Investment Banking unit generated more than 70% of the group's revenues for the first half of the year, suggesting that GS remains a trading house rather than a universal banking group despite all its massive efforts to diversify the business structure and revenue stream.

Corporate credit portfolio and CRE book are heavily skewed toward risky non-investment-grade borrowers

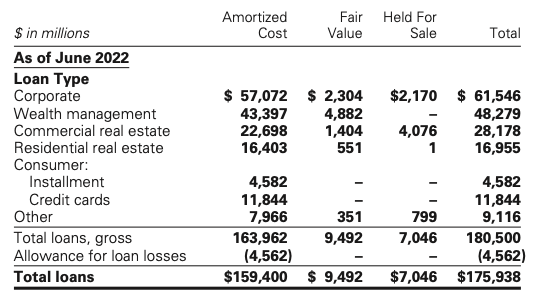

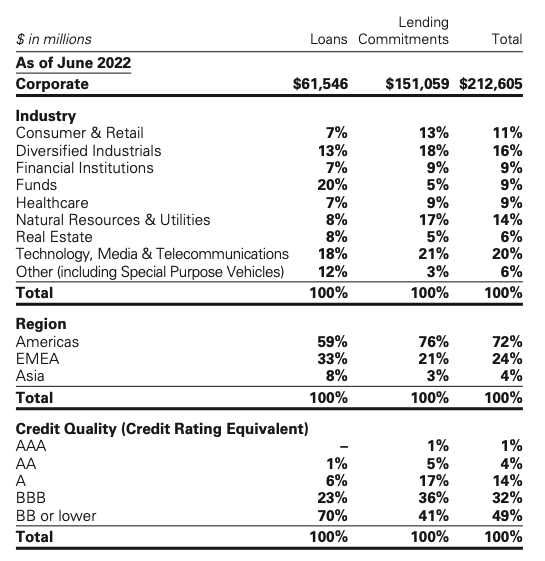

Despite the massive push into retail, corporate portfolio represented 34% of the bank's total gross loans as of 6M22.

Company Data

GS's corporate book is extremely risky as 70% of loans were granted to non-investment-grade borrowers. The history tells us that there is a high probability that these borrowers would default in a recession environment. It is also worth mentioning that 33% of corporate loans were granted to EMEA's clients, which would likely hit the hardest in a global crisis.

Company Data

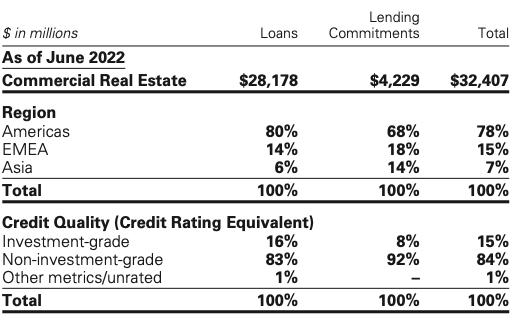

If we look at GS's commercial real estate (CRE) portfolio, the situation looks even worse as 83% of the group's loans were granted to non-investment-grade borrowers (or 84% if we add lending commitments).

Company Data

Funding structure remains volatile and expensive

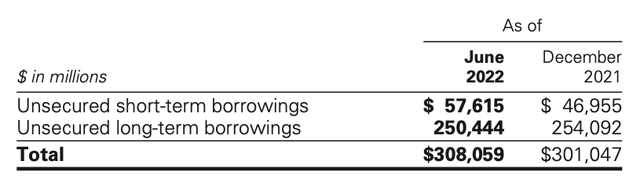

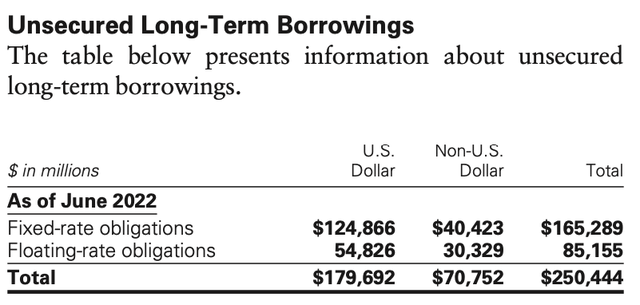

As we noted earlier, GS managed to attract more than $110B of retail deposits since the launch of Marcus. However, the bank still heavily relies on unsecured wholesale borrowings, which is one of the most volatile and expensive sources of funding for a bank. As of 6M22, GS has more than $300B of these borrowings.

Company Data

Company Data

These borrowings are also quite expensive and their cost is rising, as, according to GS, the aggregate amounts of unsecured long-term borrowings had weighted average interest rates of 2.69% (3.54% related to fixed-rate obligations and 2.63% related to floating-rate obligations) as of June 2022. These compare to 1.60% (2.25% related to fixed-rate obligations and 1.48% related to floating-rate obligations) as of December 2021.

Significant exposure to equities, corporate debt, and non-U.S. government bonds

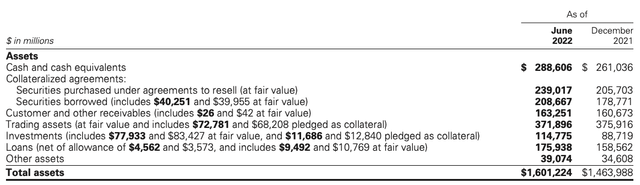

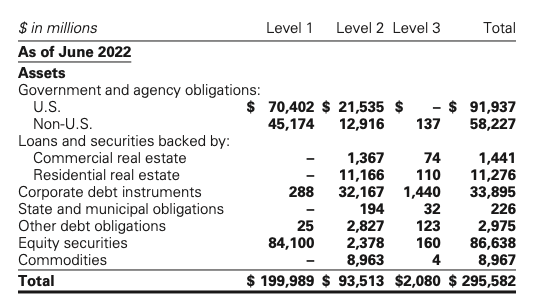

As the table below shows, unsurprisingly GS has a lot of its securities on its balance sheet.

Company Data

Trading assets, which are the largest part of the bank's securities book, consist of trading cash investments and derivatives.

Below is a breakdown of trading cash investments.

Company Data

GS has almost $60B of non-U.S. government obligations, $34B of corporate debt, and $87B of equities. As a reminder, GS's total retail deposits are $110B.

Bottom Line

In contrast to Goldman Sachs, our Top U.S 15-banks identified at Saferbankingresearch.com have profitable business models, high-quality borrowers, minimal exposure to corporate and CRE lending, stable funding structure with reliance on retail deposits, and also very conservative securities books, which consist predominantly of U.S Treasuries and U.S municipal bonds.

Moreover, GS has more red flags, which we did not discuss in detail due to the limitations of the article, such as reliance on investment-banking revenues, the bank's off-balance sheet items and a potential increase in RWA (risk-weighted assets) in a volatile environment. However, all our Top-15 banks have been tested for these red flags to ensure their long-term stability.