Even The FDIC Is Getting Worried About Banks

See our latest article on bank safety, titled "Even The FDIC Is Getting Worried About Banks."

The FDIC has recently published its Quarterly Banking Profile for the fourth quarter of 2023. In our view, this report looks quite interesting as it has further revealed a number of issues in the U.S. banking system. Of course, for everyone who's following our banking articles, these problems should not come as a surprise, as we have been warning our readers of these issues for the past two years.

First, it's worth noting that the FDIC’s rhetoric has changed from rather optimistic to quite cautious. In our view, this should have been done two years ago, when forward-looking indicators signaled a lot of issues in the system.

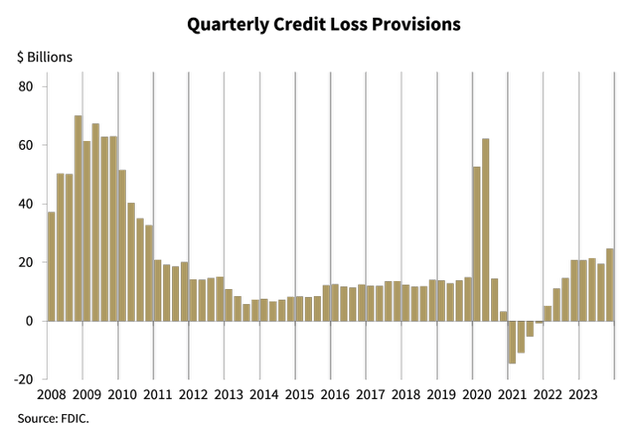

According to the regulator, the sector’s loan loss provisions increased by $5.2B QoQ and reached $24.7B. The FDIC said that this was due to higher credit card balances and charge-offs, greater risk in office properties, and increasing delinquency levels across loan portfolios. We have published a lot of articles on these credit segments, and our clients are well aware of major credit quality issues in the U.S. banking system. Notably, as the chart below shows, with the exception of the two pandemic quarters in 2020, credit loss provisions for the fourth quarter of 2023 were the highest since the fourth quarter of 2010. Needless to say, pandemic quarters were a one-off, but now we're seeing a sustainable trend of asset quality worsening.

FDIC

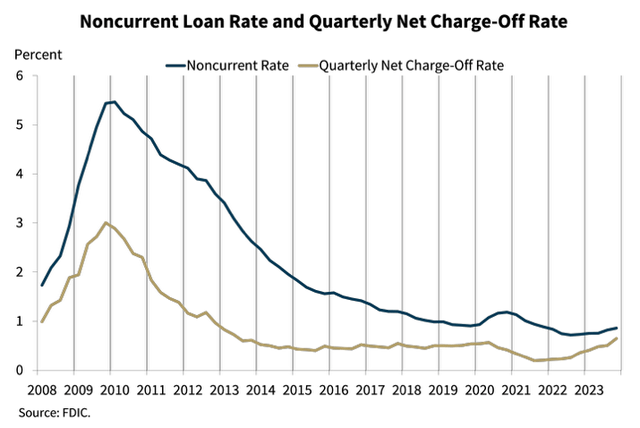

The next chart shows that the sector’s non-current loan rate and net charge-off rate also increased quite significantly in 4Q23. Unsurprisingly, the increase in noncurrent loans was the largest among CRE loans and credit cards. According to the FDIC, the noncurrent rate for non-owner-occupied CRE loans is now at its highest level since the first quarter of 2014 while the noncurrent rate for credit card loans is at its highest level since the third quarter of 2011.

FDIC

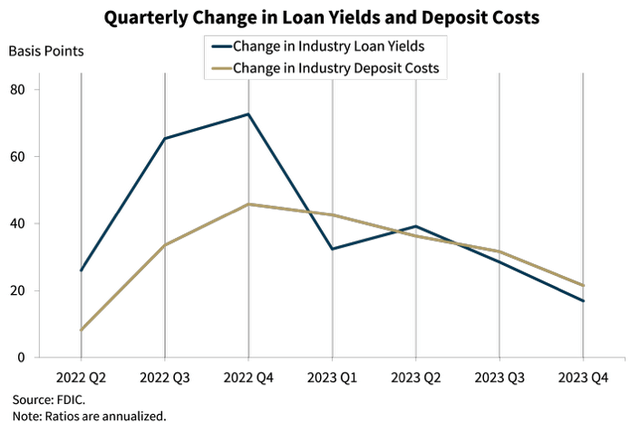

Another issue is the ongoing margin pressure, which we also have discussed in our previous articles. What looks especially concerning in this FDIC report is that for the second consecutive quarter, deposit costs increased faster than loan yields. This affects not only the U.S. banks’ profitability levels but also their balance sheet structures. In order to somehow alleviate the margin pressure, U.S. banks have significantly increased their shares of low-quality loans to shadow banking intermediaries and started buying high-risk structured products such as CLOs (collateralized loan obligations).

FDIC

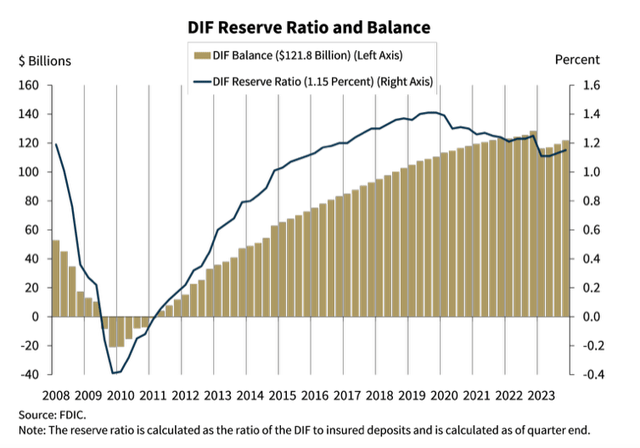

Finally, for those who still rely on the FDIC, we would like to show the following chart.

FDIC

Source: FDIC

You can see the FDIC balance during the 2009–2011 period, and you can see the current DIF reserve ratio, which is 1.15%. As a reminder, the DIF reserve ratio shows the fund balance relative to the system’s insured deposits.

Bottom Line

As we have been expecting over the last two years, the factual data from the FDIC confirms a difficult operating environment building for U.S. banks.

I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, details for which are here.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Review our due diligence methodology outlined here.