Do you REALLY Know The Risk In Your Bank?

Latest article on bank safety by our team, titled "Do you REALLY Know The Risk In Your Bank?"

Lately, there have been quite a few articles and comments discussing the U.S. banking sector’s resilience to potential financial shocks and crises. Most of them are based on a macro or so-called top-down approach.

If you follow our work on banking, you know we have been analyzing various issues embedded in U.S. banks’ balance sheets. However, in this article, we aim to reiterate why some analysts fail to fully grasp two key principles of our approach: 1) a bottom-up analysis, and 2) a focus on forward-looking indicators rather than relying solely on current numbers.

First, let’s clarify what we mean by a bottom-up approach in banking analysis. U.S. banks’ balance sheets have changed dramatically since the GFC. These changes include both the structure of balance sheets and the risk profiles they carry. Before the GFC, the U.S. banking system’s primary weakness was risky mortgage lending. At the time, mortgages metrics like loan-to-value (LTV) ratios often exceeded 100%, debt-to-income (DTI) ratios averaged 50%, and payment-to-income (PTI) ratios climbed to nearly 40%. These lax standards were a key driver of the GFC.

Post-crisis reforms led to stricter underwriting and credit standards for mortgages. Today, the average LTV hovers around 90%, DTI ratios average 35%, and PTI ratios are capped at 31%. These changes have made mortgage lending the most conservative segment of U.S. banks’ loan portfolios. However, the more conservative the product, the lower the margin it generates. Consequently, banks have shifted focus to less regulated, higher-margin credit products, making it critical to scrutinize bank financial statements and analyze the composition of their assets. This granular examination of risks and exposures is the essence of our bottom-up approach.

In previous articles, we’ve highlighted numerous risks embedded in banks’ balance sheets. While a single major issue (subprime mortgages) triggered the 2008 crisis, today’s banks face multiple large-scale vulnerabilities. In our view, the current banking environment presents greater systemic risks than those seen during the 2008 GFC.

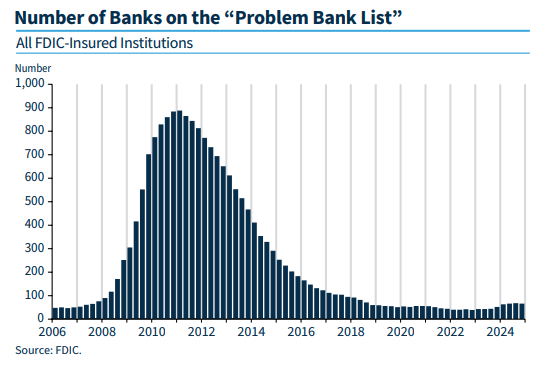

The second principle of our analysis centers on forward-looking indicators rather than relying solely on current metrics. Many analysts cite the FDIC’s chart below, which shows that the number of banks on the FDIC’s “Problem Bank List” is near historic lows.

The key issue with this chart and the FDIC’s approach to identifying “problem banks” is that the agency focuses solely on current metrics. There are many examples of why this approach is flawed, but we will highlight one critical case. According to the latest available data, 1,788 U.S. banks have total commercial real estate (CRE) lending exposures exceeding 300% of their equity capital.

Among the 10 largest U.S. banks, seven have CRE exposures greater than 50% of their total equity capital, including:

- JPMorgan (56%)

- Wells Fargo (80%)

- U.S. Bank (77%)

- PNC (88%)

- Truist (89%)

- Capital One (51%)

- TD Bank (74%)

Many institutions with assets between $50-100B have CRE exposures ranging from 350% to 500% of equity. A notable example is Flagstar Bank (the rebranded entity of New York Community Bank/NYCB), which holds a balance sheet exceeding $100 billion and CRE exposure of 541%—the highest in its category.

A joint study by USC, Columbia, Stanford, and Northwestern warns that one-third of all CRE loans—and the majority of office-related loans—face significant cash flow shortages and refinancing challenges. This aligns with our previous analysis: U.S. banks have widely adopted an “extend and pretend” strategy, delaying losses on impaired CRE loans to avoid capital write-offs. As the New York Fed notes, this practice leads to credit misallocation and growing financial fragility, culminating in a “maturity wall” of loan defaults expected to peak between late 2025 and 2027.

A 33% non-performing loan (NPL) ratio for CRE loans would erase 33% of equity capital for banks with exposures above 100% of equity. For the ~2,000 banks with CRE exposures exceeding 300%, this could mean total insolvency.

Yet the FDIC’s “problem bank” list—which focuses on backward-looking metrics—fails to account for these risks, reporting fewer than 100 institutions in distress. This drastically understates the crisis, as CRE exposure alone threatens nearly 2,000 banks. Worse, this analysis excludes other vulnerabilities like credit card debt, auto loans, non-U.S. corporate lending, shadow banking ties, and high-risk trading assets.

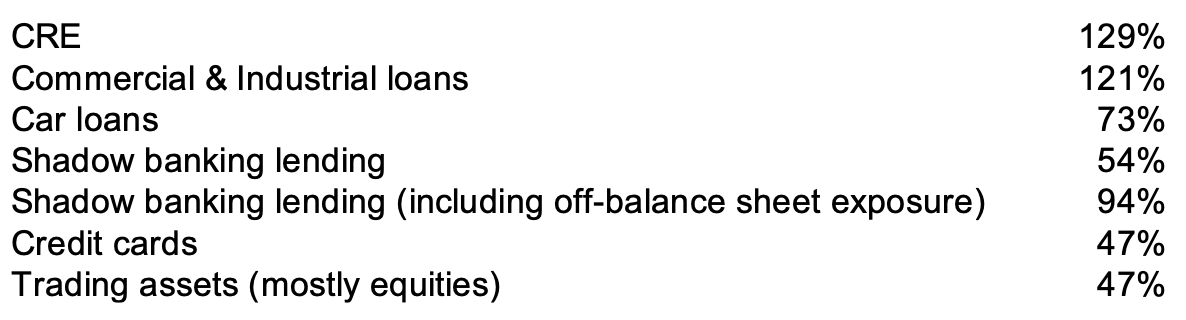

The table below illustrates how key risk segments in the U.S. banking system compare to total equity capital. These concentrations highlight systemic vulnerabilities and underscore why relying on broad macroeconomic indicators—rather than institution-specific analysis—poses risks for retail depositors.

Credit segment, as a % of the system’s total equity

As you can see, even one of these segments could lead to major issues for U.S. banks. More importantly, the uneven distribution of these risks once again highlights the importance of a bottom-up approach and a focus on forward-looking indicators. We’ve already mentioned that 1,788 U.S. banks have CRE exposures exceeding 300% of their equity capital. In addition, out of $1T of the sector’s trading assets, $937B is owned by JPMorgan, Bank of America, Citi, Goldman Sachs, and Morgan Stanley. Moreover, almost 70% of loans to shadow bankers were granted by the 25 largest U.S. banks. Again, it is extremely important to take a deep dive into the banks’ financial statements.

If you follow our work on banking, you’re familiar with all the issues that are sitting on the U.S. banks’ balance sheets. We would like to once again warn that a focus on a broad macro picture and current indicators are likely to lead to major problems for retail depositors.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets.

These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to review and utilize our due diligence methodology here.