Consumer Debt Could Be A Bigger Issue For Banks Than Commercial Real Estate

Consumer Debt Could Be A Bigger Issue For Banks Than Commercial Real Estate

By Avi Gilburt in combination with Renaissance Research

We have been publishing articles on various issues in the U.S. banking system for more than two years. The latest results show that our estimates and predictions, as well as our focus on forward-looking indicators, have proven to be correct. We're already seeing signs of major stress, putting pressure on U.S. banks’ balance sheets. The recent data on CRE lending is simply horrendous, and given what the mainstream financial media is saying, very few were expecting a 20%-plus default ratio in this segment, despite all the issues in the CRE space. If you follow our banking work, you’ve probably noticed that we were expecting (and still expect) an even higher default ratio based on our analysis of forward-looking indicators.

In this article, we’d like to discuss two segments of consumer debt which we think will also have a significant impact upon bank risks: Credit cards and car lending.

The mainstream financial media, as well as analysts from investment banks and rating agencies, are still largely ignoring major issues in these two parts of the banks’ businesses. However, our analysis and forward-looking indicators suggest that issues in credit cards and car lending could likely lead to an even more severe crisis than we're currently seeing in the CRE space.

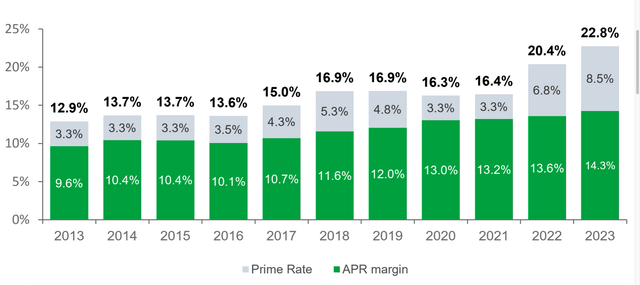

Credit card debt increased by almost 15% YoY in 2023 and reached the historical high of $1.13 trillion. The segment has been growing very strongly lately, despite the fact that the average APR (annual percentage rate) reached 22.8% in Q42023, which is the highest level recorded since the Fed began collecting this data in 1994.

CFPB, Fed

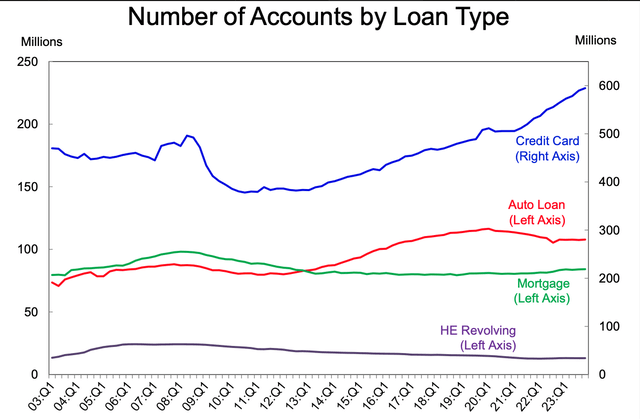

The chart below shows that there has been a significant increase in new credit card accounts over the past two years. This implies that such strong growth is being driven by both new volumes from existing customers and new accounts.

NY Fed

It looks somewhat odd, but despite a still-healthy job market, consumers are increasingly borrowing significant amounts at a 23% rate. Banks are ignoring enormous risks in this space and continue to approve those 23%-plus rate credit cards, as they need to somehow support their margins on the back of rising funding costs.

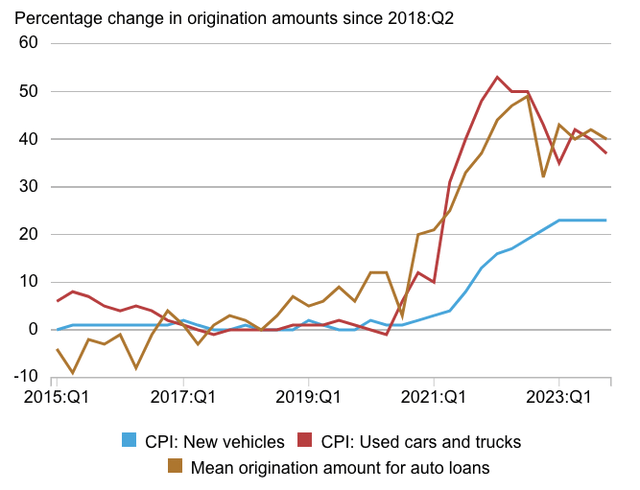

Another segment of consumer debt that has been showing rising volumes is car lending. The chart below demonstrates that there has been a very significant increase in the mean origination amount for auto loans, driven by a 50%-plus CPI in used cars.

NY Fed

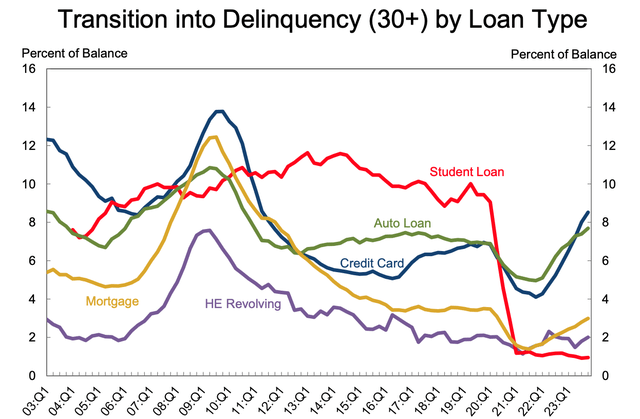

Unsurprisingly, strong growth in credit cards at a 23% average rate and a massive increase in the mean origination amount for auto loans have already led to asset quality issues. In Q42023, 8.5% of credit card balances and 7.7% of auto loans transitioned into delinquency. The chart below demonstrates that those are really high transition rates compared to recent quarters.

NY Fed

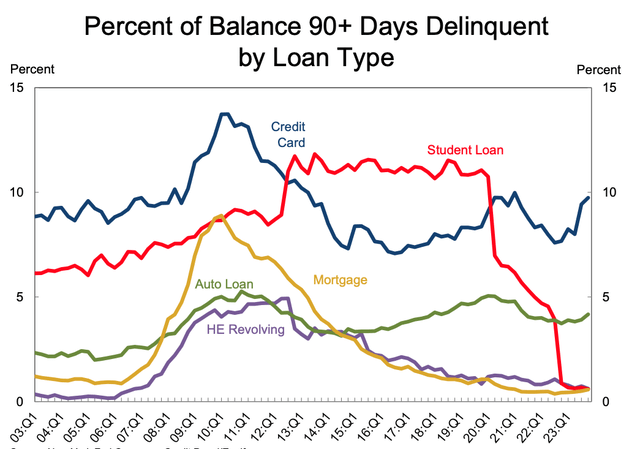

And here's the chart showing the percentage shares of 90-day plus delinquent loans. There was a large increase in credit cards while car loans have almost reached their Great Financial Recession peak. Given the transition rates we discussed earlier, the shares of delinquent loans for both credit cards and car loans are very likely to increase even more in the coming quarters.

NY Fed

Bottom line

Credit cards, auto loans, and CRE lending are only a few of the many issues that the U.S. banking system is currently facing. In our previous articles, we also discussed various problems with commercial lending and non-U.S. loans. There are also many issues with liquidity, securities books, derivatives, and off-balance sheet exposure, which we have outlined as well in prior articles. Whereas the 2007-2009 financial crisis had one main issue that caused the banking meltdown at the time, we're currently heading into an environment with multiple issues sitting on many bank balance sheets.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank (NYCB) is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail, well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to use our due diligence methodology outlined here.