Commercial Real Estate May Cause The Next Financial Crisis

The latest in our series about bank safety, published today on Seeking Alpha, titled, "Commercial Real Estate May Cause The Next Financial Crisis."

As part of our ongoing series of articles on bank stability, and at the request of many of our clients at Saferbankingresearch.com, we wanted to address the major risks we foresee for bank stability in the coming years.

But before we begin, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, details for which are here.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail, well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

In our previous article, Our Banks Are Sick And We Are Watching A Slow-Motion Train Wreck on bank stability, we discussed the recent report from Moody's on U.S. banks, which came out with a significant time lag relative to our analysis.

If you have been following our work on banks, you would know that we have been discussing the issues to which Moody's was recently referring for the past 18 months. We also noted that Moody's, as well as other rating agencies and research departments of investment banks, have mostly ignored several major issues that were revealed by the U.S. banks' 1H23 results. In our view, each of these issues is a major risk for bank stability, and each of them is worth a separate article. In our first article, we discussed consumer lending and its significant negative impact on the stability of the banking sector.

This is the second in this series of articles within which we will discuss commercial real estate (CRE) lending.

Bank-held CRE loans reached more than $3.0T by the end of 1Q23

According to the latest report published by the FDIC, bank-held CRE loans reached more than $3.0T by the end of 1Q23. Importantly, according to the regulator, 30% of the banks (1,402 banks) have an elevated concentration of CRE loans defined as exceeding 300% of capital (tier 1 capital and credit loss reserves for loans and leases) or construction and development (C&D) loans exceeding 100% of capital. Those are really very concerning numbers.

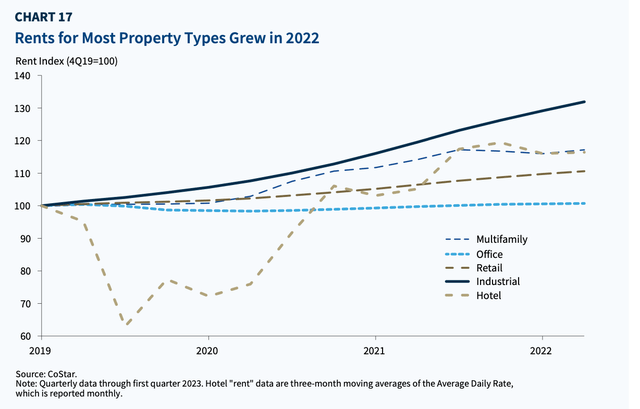

The mainstream financial media has recently started discussing CRE lending, and some pundits said that it would likely trigger a major crisis in the U.S. banking sector soon. However, while we are also skeptical about the CRE segment, we note that it is crucial to understand that there are five major CRE property types: 1) Multifamily; 2) Office; 3) Retail; 4) Industrial; and 5) Hotel. Some of them do have major issues, but others are doing quite well. The chart below shows that four out of the five major CRE property types have been performing quite well in terms of demand and pricing.

FDIC

According to the FDIC, office fundamentals have been very weak lately due to the ongoing shift to remote work, which has had a negative impact on office demand, particularly in some larger urban areas. According to the regulator, anecdotal evidence reveals that office building owners have increased free rent and allowances for tenant renovations while decreasing effective rents. The main office markets in the country have seen significant increases in the amount of office space available for subleasing, which is leased at rents discounted from the underlying lease agreement and has surpassed levels seen during the Great Recession. As of the end of 1Q23, San Francisco, which has a large concentration of tech companies, had the highest rate of sublease availability at 6.3%, followed by Seattle at 3.2%. The FDIC also added that industry forecasts project further increases in the national office vacancy rate through 2023, and low office attendance by workers suggests weakness in office properties.

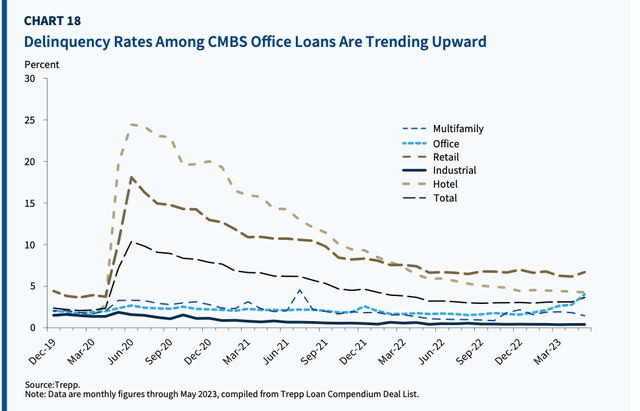

Importantly, the asset quality of office-related CRE loans has already started to deteriorate. The chart below shows that the delinquency rate among offices has increased since the beginning of 2023.

FDIC

CRE exposure is also an issue for larger U.S. banks

If you follow mainstream financial media, then you have probably noticed that they say that CRE lending is mainly an issue for smaller community banks. Without a doubt, some smaller banks have major issues with their CRE loans, and all depositors should take a closer look at their banks' CRE books. However, there are community banks that have excellent metrics of their CRE credits. For example, at SaferBankingResearch.com, we have several banks that have exposure to CRE lending, and 20-25% of their total loans were granted to this segment. Yet they are performing very well and were profitable even during the Great Recession.

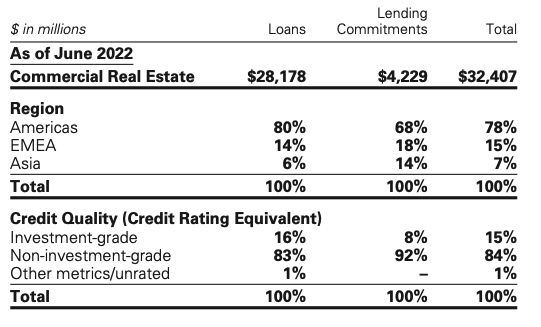

The problem is that mainstream financial media fail to mention that there are a lot of large U.S. banks that have serious issues in the CRE space. Almost a year ago, we published an article titled Is Your Bank Safe? A Look At Goldman Sachs on Goldman Sachs (GS), saying that its CRE book looks extremely risky as 83% of the group's loans were granted to non-investment-grade borrowers, which are often called "junk" borrowers.

Company Data

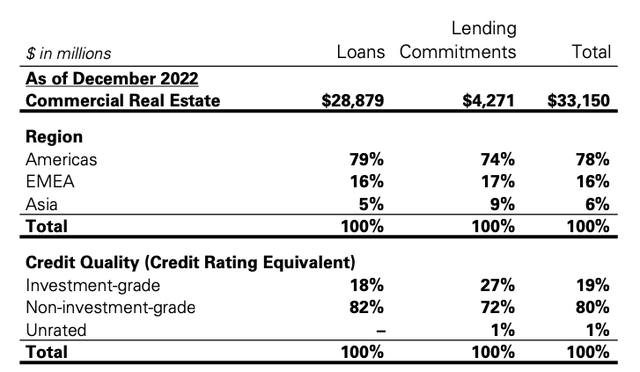

The bank's latest 10-K tells us that the situation has not changed, as 82% of GS's CRE loans were granted to junk borrowers.

Company Data

The bottom line

In our view, there are two key takeaways from the data we discussed. First, there are major issues in the CRE lending space. However, the CRE space has different segments, and some of them are performing quite well. As such, retail depositors should do thorough due diligence on their banks' CRE books.

Second, not only will smaller community banks likely struggle with CRE loans, but even large banks have issues with this segment. As we discussed, 82% of Goldman Sachs' CRE loans were granted to junk borrowers.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And, if you're relying on the FDIC, I suggest you read our prior articles which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to utilize our due diligence methodology, which is outlined here.