'Climate Chaos' Can Sink Major Banks

'Climate Chaos' Can Sink Major Banks

By Avi Gilburt in combination with Renaissance Research

The 2024 Banking on Climate Chaos report was published this week. This report examines the global banking industry’s exposure to fossil fuel financing. We're closely following these reports, as energy-related loans generally tend to be one of the worst-performing lending segments from an asset quality perspective in a crisis environment.

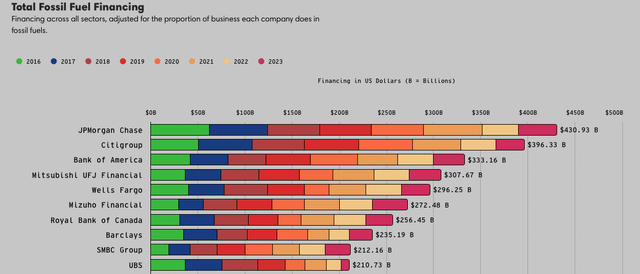

Here are the top 10 global banks with the largest amounts of fossil fuel financing over the 2016–2023 period. There are four US banks, three Japanese banks, a Canadian bank, a UK bank, and a Swiss bank.

Bankingonclimatechaos.org (Bankingonclimatechaos.org)

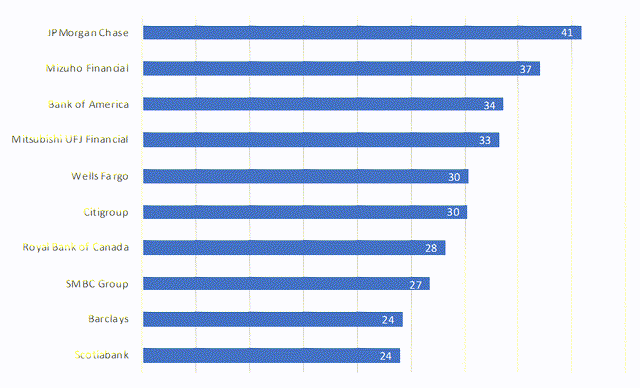

And here are the Top-10 banks in 2023. As you can see, JPMorgan (JPM) is still the leader, while UBS (UBS) was replaced by The Bank of Nova Scotia (BNS).

Total fuel financing, 2023, $ B

Bankingonclimatechaos.org

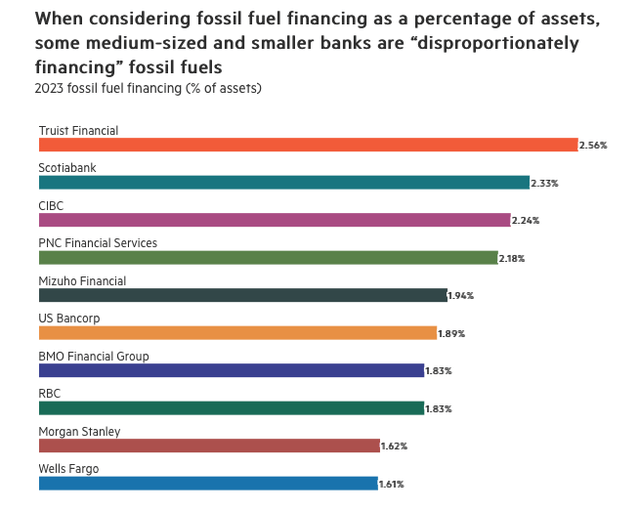

Absolute numbers do not help much, as obviously these banks have different asset bases and loan portfolios. The Banker compared the banks’ fossil fuel financing to their total assets. As the chart below shows, this gives a different picture.

The Banker

Surprisingly, in 2023, Truist (TFC) had the largest amount of fossil financing relative to its total asset base, while PNC (PNC) was the fourth. Both Truist and PNC are Top-10 US banks, but they are beyond Top-50 global banks.

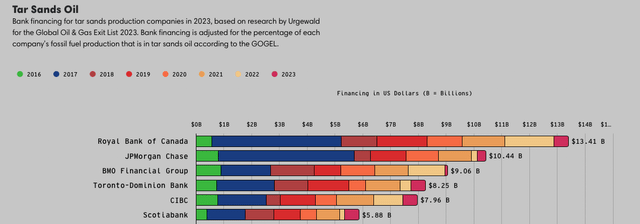

There are also four Canadian banks in this list. We have been saying to our subscribers for more than a year that, despite all the rhetoric, Canadian banks have been increasing their exposure to fossil fuel financing, which has clearly increased their risk. Moreover, five of the six largest global financiers of the tar sands are Canadian banks, even in absolute terms.

Bankingonclimatechaos.org

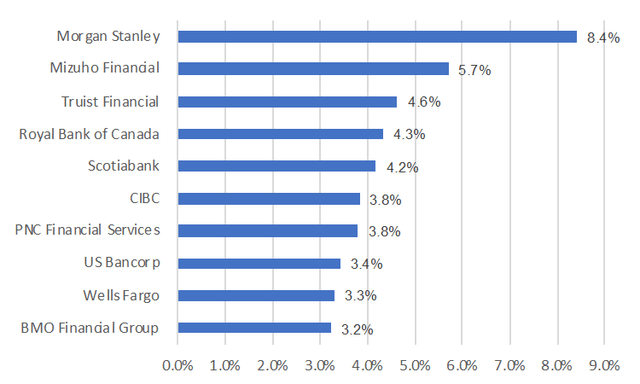

We have also done an additional exercise and compared amounts of fossil fuel financing to loan portfolios for those banks that have disproportionately financing fossil fuels. Here are the results.

Fossil fuel financing in 2023, as a percentage of total outstanding loans

Bankingonclimatechaos.org, Companies data

Bottom Line

We have published a lot of articles on the Big-4 U.S. banks and their issues, but this article is a reminder that other Top-10 banks, such as Morgan Stanley (MS), Truist, PNC and U.S. Bancorp (USB) also have issues. Importantly, while their exposure to fossil fuel is an added risk on their balance sheets, it's clearly not the only risk.

In our previous articles, we also discussed various problems with CRE lending, credit cards, auto loans, commercial lending, and non-U.S. loans. There are also many issues with liquidity, securities books, derivatives, and off-balance sheet exposure which we have outlined as well in prior articles. Whereas the 2007-2009 financial crisis had one main issue that caused the banking meltdown at the time, we're currently heading into an environment with multiple issues sitting on many bank balance sheets.

This is also should serve as a reminder of the risk for clients of Canadian banks, which also have massive exposure to fossil fuel financing. The Canadian banks were among the safest in the world during the 2008–2009 crisis, but their business models have changed significantly since then. There are 34 domestic banks in Canada, and it’s a quite small and oligopolistic market. In fact, we could only find two banks that meet our banking safety criteria. Those two banks are the best we could find in Canada, and they're the best choice for those Canadians who want to keep their money in their country. But those who have the opportunity to open an account at a U.S. or European bank should take a look at our top banks to diversify their savings. Ultimately, the Big Six did not meet our standards.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bancorp (NYCB) is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify, in a public article, the exact reasons which caused SVB to fail, well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. See our due diligence methodology outlined here.