Big Banks Have Massive Exposure: The Fed Does Not Have Your Back

Here's our latest public article about bank safety, initially published on Seeking Alpha, titled "Big Banks Have Massive Exposure: The Fed Does Not Have Your Back."

As part of our ongoing series of articles on bank stability, and at the request of many of our clients at Saferbankingresearch.com, we wanted to address the recent Fed stress test results in this missive.

I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you. The substance of that analysis is not looking too good for the future of the larger banks in the United States. You can read about them here.

The Fed recently released the results of its annual bank stress tests. We have written a lot about why the Fed's stress tests do not reflect how the actual financial conditions of U.S. banks would look under a sharp recession scenario. But this year's tests look really odd, as two large banks reported that there were significant discrepancies between how the Fed and the banks' own models predicted how the lenders would perform in a crisis scenario.

Importantly, the banks' estimates were more conservative, as the Fed predicted their key financial metrics would be much better during a system shock. To put it mildly, this does not look normal, given that any banking regulator should be more conservative than the banks that it supervises. We believe that this year's stress tests have demonstrated that this exercise is futile, and depositors should not rely on it when choosing a bank for their savings.

Bank of America's internal stress tests showed a higher loss and a lower capital ratio

On June 28th, the Fed published the results of its 2023 annual stress test. In its press release, the regulator said that the results of the test "demonstrate that large banks are well positioned to weather a severe recession and continue to lend to households and businesses even during a severe recession."

On July 3, Bank of America (BAC) issued quite a surprising statement, saying that "Bank of America initiated dialogue with the Federal Reserve to understand differences in Other Comprehensive Income over the 9-quarter stress period between the Federal Reserve's CCAR results and Bank of America's Dodd-Frank Act stress test results."

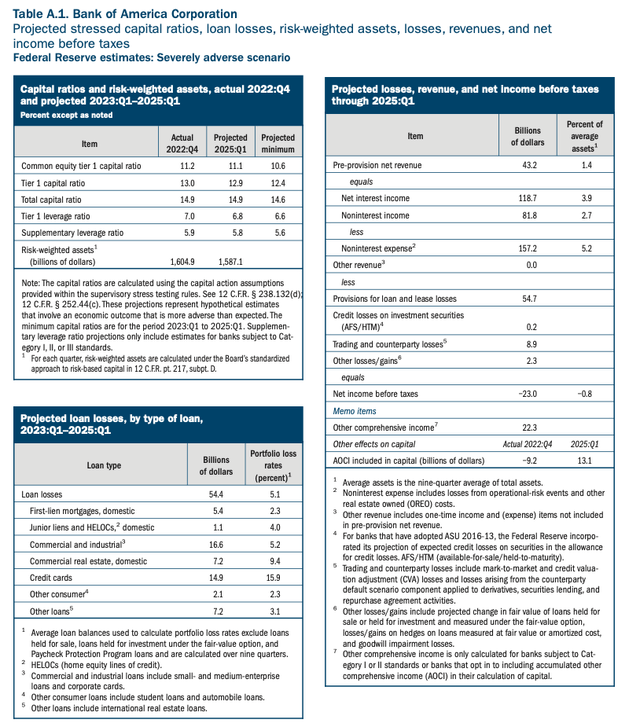

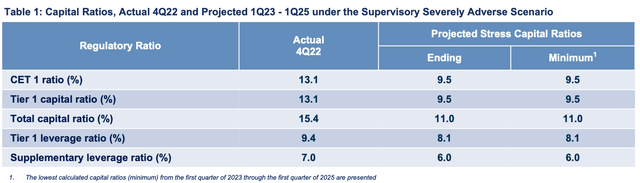

The tables below show how the Fed expects BAC to perform under the so-called severely adverse scenario.

The Fed

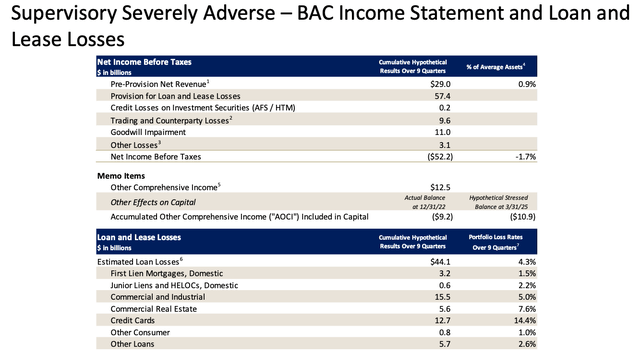

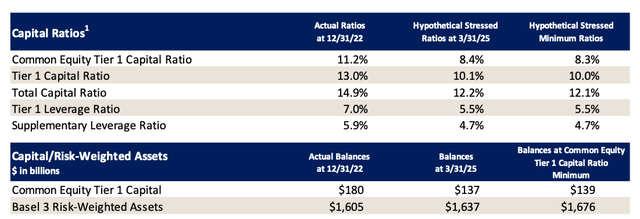

And here are the slides from BAC's presentation that show how the bank's own models predict it would perform under the same scenario.

Bank of America

Bank of America

As we can see, there are several significant discrepancies. First, BAC's internal stress test shows that the bank would post a loss of $52.2B under the severely adverse scenario, while the Fed expects the bank to lose only $23.0B. Second, BAC estimates that its other comprehensive income would be $12.5B, while the Fed's tests show it would be $22.3B. Due to a combination of a bigger loss and lower other comprehensive income, BAC expects its CET1 capital ratio to fall to 8.3%, while the Fed said the ratio would decline to 10.6%.

As we said earlier, it looks odd. This implies that the Fed is much less conservative than the banks that it regulates. Needless to say, a banking regulator should be as conservative as possible in such an important exercise as a stress test. At the end of the day, the results of these tests are used to determine how much capital the banks need.

We understand that the Fed and BAC could use different modeling techniques, but this certainly should not lead to these large discrepancies. As such, the discrepancies suggest that either the Fed's models are simply wrong or the regulator uses much milder assumptions than those officially published.

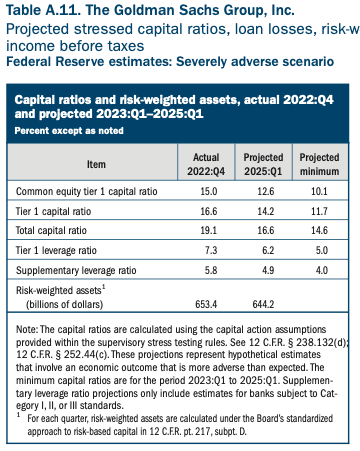

Moreover, there was also a discrepancy in Goldman Sachs' (GS) results. GS predicted that its CET1 capital ratio would fall to 9.5%, while the Fed estimated it would decline to 10.1%.

The Fed

Goldman Sachs

The Fed said that "the largest banks' trading books were resilient to the rising rate environment tested"

When the Fed announced its scenarios for 2023 stress tests, the regulator said that for the first time it would publish an additional, exploratory market shock component that will be applied to U.S. G-SIBs. In one of our previous articles, we said:

According to the regulator, the exploratory market shock is characterized by a recession with inflationary pressures induced by higher inflation expectations. As such, this scenario implies much higher Treasury yields compared to "the severely adverse scenario," and it would be very interesting to see the banks' losses from negative revaluations of the Treasuries and other bonds on their balance sheets. However, we are yet to see how the Fed will conduct this test, and what assumptions the regulator will use."

But the Fed did not provide any estimates on the exploratory market shock component, and just said the following:

For the first time, the Board conducted an exploratory market shock on the trading books of the largest banks, testing them against greater inflationary pressures and rising interest rates. This exploratory market shock will not contribute to banks' capital requirements but was used to further understand the risks with their trading activities and to assess the potential for testing banks against multiple scenarios in the future. The results showed that the largest banks' trading books were resilient to the rising rate environment tested."

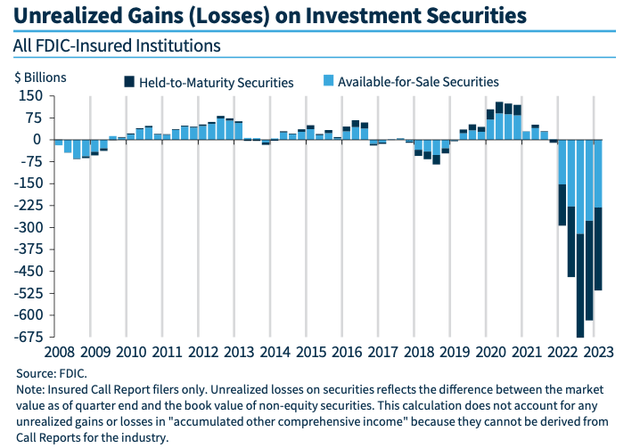

This also looks very odd as rising interest rates already have led to large unrealized losses from long-duration securities and were even the reason for the SVB failure, as we warned just weeks before it became a public issue. Just as a reminder, U.S. banks had $515.5 billion of unrealized losses from securities as of the end of the first quarter.

FDIC

It's really difficult to find an explanation for this Fed's conclusion. One explanation might be that the Fed tested only the trading part of the banks' securities and did not do any tests for the banks' available-for-sale and held-to-maturity securities. But this would be weird, as trading books are much smaller compared to available-for-sale and held-to-maturity securities.

Another possible explanation is that the Fed assumed that only short-term rates would rise significantly while long-term rates would increase only moderately. But this also makes little sense, as large U.S. banks have long-duration securities books, and it would be very interesting to see how those books would react to an increase in longer-term rates.

After all, U.S. banks had been operating in a low-to-zero interest rate environment quite recently, and while it put pressure on their interest income due to lower margins, it did not lead to major failures. Obviously, a stress test that assumes higher inflation and higher interest rates would be more helpful.

Bottom line

We have been skeptical of the Fed's stress tests for quite some time, but this year's results have undermined their credibility even further, in our view.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money. You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And, if you're relying on the FDIC, I suggest you read our prior articles which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. The methodology we outline is here.