Big Banks Have Massive Exposure: Recent Banking Results Are Concerning

Here's our latest public article about bank safety, initially published on Seeking Alpha, focusing on Canadian banks and titled "Big Banks Have Massive Exposure: Recent Banking Results Are Concerning."

As part of our ongoing series of articles on bank stability, and at the request of many of our clients at Saferbankingresearch.com, we wanted to address the latest results of the Q2 reporting of the Big Six Canadian banks.

I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you. The substance of that analysis is not looking too good for the future of the larger banks in the United States. You can read about them here.

Moreover, if you believe that the banking issues have been addressed, I am sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

Now, moving into the topic of this specific article, the Big Six Canadian banks have recently reported Q2 results, and the numbers confirmed various concerns that we have discussed in our previous articles. Canadian banks are very likely to face major credit quality issues due to a combination of significant exposure to variable-rate residential mortgages, a higher-for-longer interest rate environment, and a very elevated level of household debt in Canada. Moreover, there is also pressure on the revenue side.

Persistent inflation suggests a higher-for-longer interest rate environment in Canada

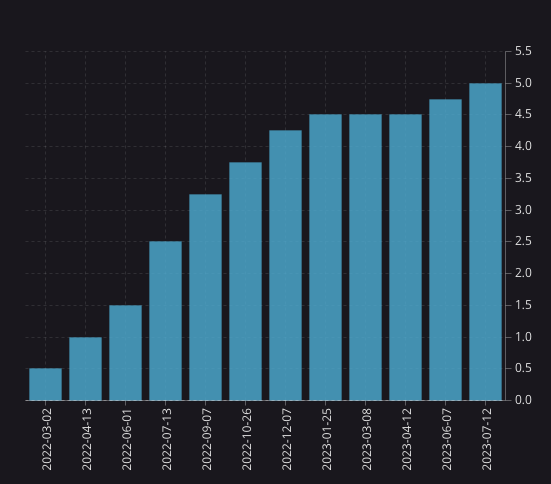

On July 12, the Bank of Canada raised its policy rate by another 25 bps to 5%. As the chart below shows, the regulator has increased its benchmark rate by 475 bps since March 2022.

Bank of Canada

Canada's annual inflation rate dropped to a quite low 2.8% YoY in June 2023. While this is a significant slowdown, the core inflation metrics, CPI-median and CPI-trim, were 3.9% YoY and 3.7% YoY, respectively. In its recent press release, the Bank of Canada noted the following:

While CPI inflation has come down largely as expected so far this year, the downward momentum has come more from lower energy prices, and less from easing underlying inflation. With the large price increases of last year out of the annual data, there will be less near-term downward momentum in CPI inflation. Moreover, with three-month rates of core inflation running around 3½-4% since last September, underlying price pressures appear to be more persistent than anticipated. This is reinforced by the bank’s business surveys, which find businesses are still increasing their prices more frequently than normal.

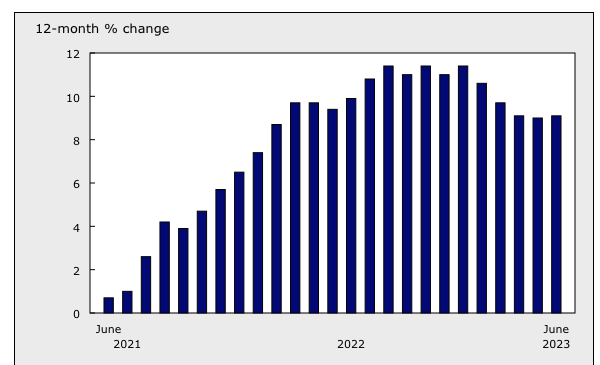

In addition, as the chart below demonstrates, grocery prices continue to increase at a high rate (+9.1% YoY in June, following a 9.0% increase in May), putting pressure on consumers.

Statistics Canada

Another large contributor to the Canadian CPI are mortgage interest costs, which spiked by 30.1% YoY in June. This should not come as a surprise given that the Canadian banking system has significant exposure to variable rate mortgages, which we have discussed in detail in our recent article on Toronto-Dominion Bank (TD).

As a result, the Bank of Canada remains quite hawkish, and this suggests that the Canadian economy will operate in a higher-for-longer interest rate environment.

In the July MPR projection, CPI inflation is forecast to hover around 3% for the next year before gradually declining to 2% in the middle of 2025. This is a slower return to target than was forecast in the January and April projections. Governing Council remains concerned that progress towards the 2% target could stall, jeopardizing the return to price stability.

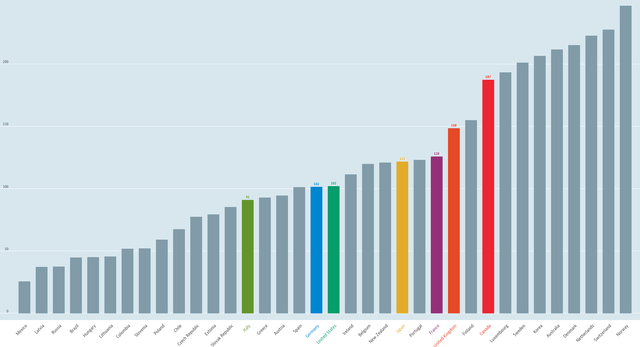

Canada’s household debt is the largest among the G-7 economies

The key thing that differentiates the Canadian economy from other developed countries that are currently increasing rates is that Canada has a very high level of consumer debt. Canada’s household debt as a percentage of net household disposable income is the highest among the G-7 economies. According to the latest data provided by the OECD, the ratio was 187%. By comparison, the respective metric for the U.S. is 102%.

OECD

As we said earlier, a combination of a higher-for-longer rate environment, a large share of variable-rate mortgages, and elevated household debt implies major asset quality issues for Canadian banks. In addition, real estate prices in Canada are likely to decline further following an almost 50% increase during the pandemic.

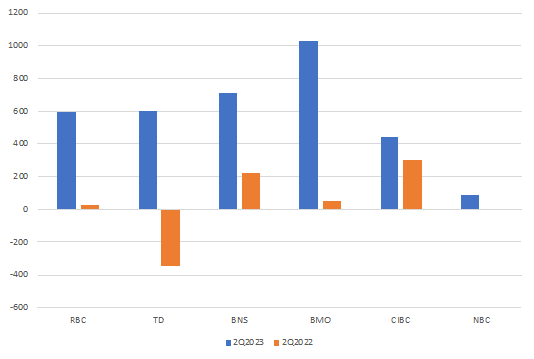

Q2 numbers reveal increases in provisions for credit losses

Notably, the Q2 numbers already have shown signs of credit quality deterioration, as all the banks in the Big Six reported annual increases in provisions. Although provisions as a percentage of loans remain low, we expect a sustainable trend of asset quality worsening going forward.

Provisions for credit losses

Company Data

* USD MM for TD, BNS. BMO and CIBC, CAD MM for RBC and NBC

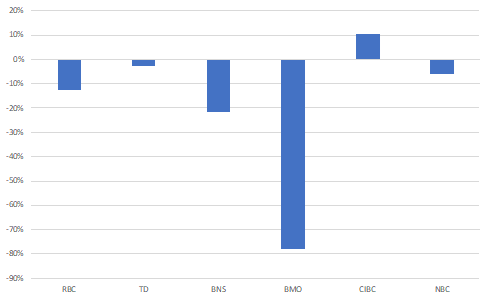

In addition, there was pressure on the banks’ revenue due to higher funding costs, lower loan growth, and a slowdown in fee income. As a result, five out of the six banks reported annual declines in earnings in Q2.

Earnings growth, 2Q2023, YoY

Company Data

Bottom Line

The Canadian banks were among the safest in the world during the 2008–2009 crisis, but their business models have changed significantly since then. There are 34 domestic banks in Canada, and it’s a quite small and oligopolistic market.

We found only two banks that meet our criteria. Those two banks are the best we could find in Canada, and they are the best choice for those Canadians who want to keep their money in their country. But those who have the opportunity to open an account at a U.S. or European bank should take a look at our top US banks to diversify their savings. The Big Six did not meet our standards.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money. You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And, if you're relying on the FDIC, I suggest you read our prior articles which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. The methodology we outline is here.