Big Banks Have Massive Exposure: A Look At Ally Financial

Here's our latest public article about bank safety, titled "Big Banks Have Massive Exposure: A Look At Ally Financial."

As part of our ongoing series of articles on bank stability, and at the request of many of our clients at Saferbankingresearch.com, we wanted to address Ally Bank in this missive. I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But, I must warn you. The substance of that analysis is not looking too good for the future of the larger banks in the United States. You can read about them here.

Ally's focus on used cars is a concern

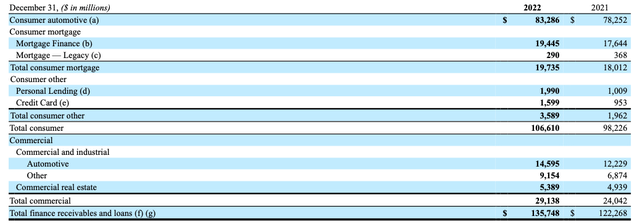

If we look at Ally Financial's (NYSE:ALLY) loan mix, it clearly tells us that the bank focuses heavily on car lending, as auto loans accounted for more than 60% of its total credit portfolio as of the end of 2022. There were also wholesale commercial automotive loans of $9B, which make Ally's total exposure to the car market as high as 72%.

Company Data

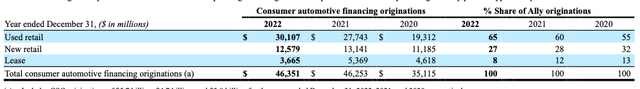

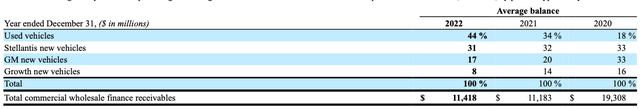

If we look deeper at the bank's financial statements, we will see that Ally has been shifting its focus from new cars to used cars lately. The table below shows that used cars accounted for 65% of all new loan originations in 2022, up from 55% in 2020.

Company Data

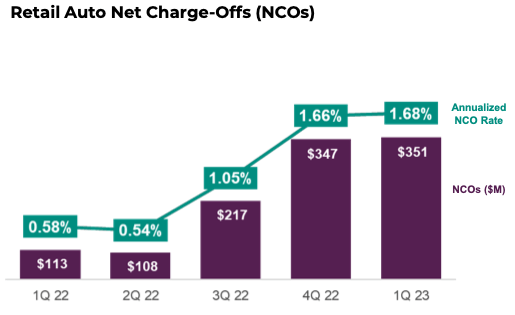

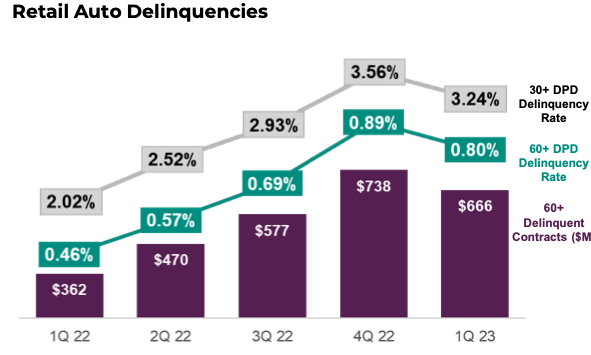

Both auto net charge-offs and auto delinquency ratios have already started rising, although their levels are still not that high.

Company Data

Company Data

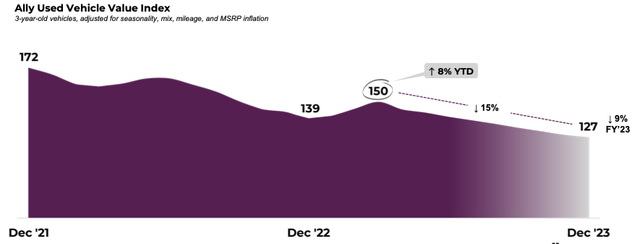

What is important here is that net charge-offs are rising despite the fact that used car prices are at very high levels and even increased by 8% YTD in 1Q23, according to the Ally Used Vehicle Value Index.

Company Data

However, even Ally, which should be more optimistic on its key business line than independent agencies, expects that used car prices will fall by 15% from the 1Q23 level by the end of the year. This is quite a sharp fall for this still relatively benign economic environment.

Notably, in its wholesale car financing, Ally is also exposed to used vehicles.

Company Data

If a major recession comes, there will be not only a larger slump in used car prices but a big increase in unemployment as well. Such a combination will highly likely lead to a spike in Ally's charge-offs and even could make it a loss-making entity quickly.

Long-duration securities book

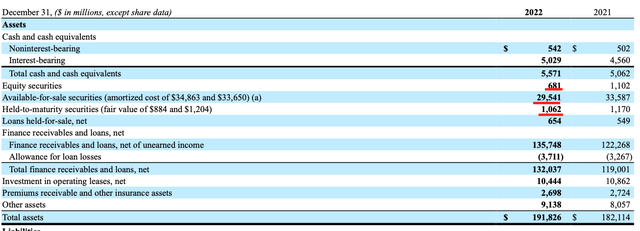

Securities accounted for more than 16% of Ally's total assets as of the end of 2022, and more than 94% of this book are available-for-sale securities.

Company Data

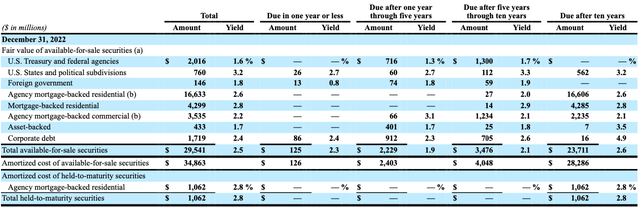

The table below shows that 80% of the bank's available-for-sale securities have maturities of more than 10 years.

Company Data

We have already written a lot on this issue in our previous articles on large banks. The recent bank failures have already demonstrated that such a longer-duration securities book is a major risk.

Capital adequacy ratios are low for such a risky business model, and the CET1 ratio is below the Fed's requirement if adjusted for AOCI

The group's CET1 ratio was 9.3% as of the end of 2022. Although this is above the 7% requirement, we believe Ally has a small capital cushion given its risky business model.

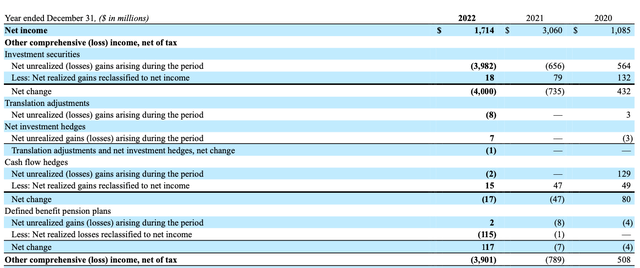

As the table below shows, for the full year of 2022, Ally's AOCI was negative $3.9 billion.

Company Data

If we adjust Ally's CET1 capital for this $3.9B loss, the bank's CET1 ratio would be 6.7%, which is below the regulatory requirement.

NIM is under significant pressure

In the retail deposit space, Ally competes with other digital banks. As of now, Ally offers a 5% rate on an 18-month CD.

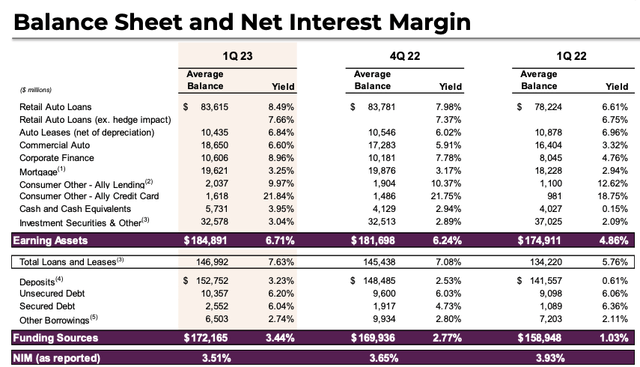

The table below shows that this fierce competition for deposits has already resulted in a significant increase in funding costs and, as a result, put pressure on NIM. We expect the bank's NIM to fall further as the liquidity situation in the U.S. banking sector remains challenging, and Ally will very likely have to increase its deposit rates to prevent large outflows.

Company Data

The bottom line

As you can see, Ally has a risky business model and a number of issues that could come to the fore in the event the market begins to move into a difficult economic environment.

In contrast to Ally, the Top-15 U.S. banks we have found at SaferBankingResearch do not have exposure to used vehicle lending, rely on much cheaper funding with sticky deposits from core customer bases, and have much higher capital adequacy ratios. The banks we have identified also have lower shares of longer-duration bonds.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money. You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And, if you are relying on the FDIC, I suggest you read our prior articles which outline why such reliance will not be as prudent as you may believe in the coming years.

It is time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. And, you can feel free to utilize the methodology we outline here.