Banking Crisis Likely On The Horizon - Are You Prepared?

As many of you know, I'm someone who sees market sentiment as quite important. So, I will tell you that we garner the least "likes" within the articles we publish warning of the banking issues we see in bank balance sheets.

Yet, one would think that warning people about how they're about to lose money would be something about which they are appreciative. With appropriate warning, they can act to prevent losses before it is too late. I mean, what would be their downside risk of putting their money into stronger banks? But, based on the response we have received, this is not so.

It would seem that people do not want to hear that their banks have any issues. This tells me that most market participants are still quite oblivious to the issues we see in the bank balance sheets or are simply choosing to ignore them. Therefore, it seems that there are very few who are preparing for what can be the worst banking crisis seen since the 2008 financial crisis or even the Great Depression.

Let's try to understand the ramifications from a historical perspective. But, first, I want to explain why I see a protracted period of economic woe on the horizon which will likely have a serious effect on the banking sector.

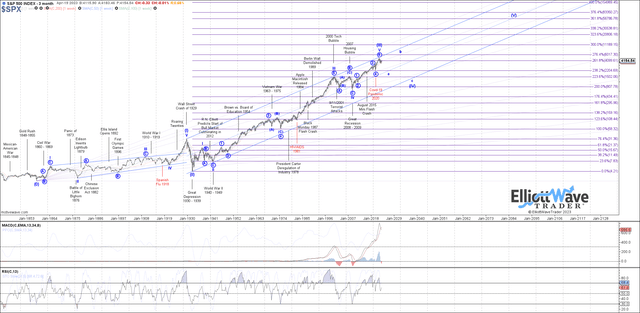

As many of you know, my primary method of analysis is based upon Elliott Wave. Elliott Wave analysis provides us with a non-linear perspective on markets, which also provides us with the overall market context that is sorely lacking in almost all other analysis methodologies.

To this end, for those that have followed me through the years, you would likely know that we have accurately called almost all the major tops and bottoms seen in the markets we cover over the last 12 years. And, it's all based upon the non-linear Elliott Wave analysis we have conducted in all those various markets we track.

Allow me to just list a sample of those calls so you can understand the power of understanding market context through the lens of Elliott Wave analysis. The following are just some of the calls our clients have outlined as the most significant calls we have made (but it's clearly not meant to be an all-inclusive list):

- July 2011: Called for a rally in DXY from 73 with a target of 103.53 while the Fed was pumping QE into the market and everyone was expecting a dollar crash. Market rallied initially to a high of 103.82 before a multi-year pullback, as we expected.

- August 2011: Called for a top in gold at $1,915 while gold was going through a parabolic rally. Also called for a downside target of the $1,000 region before it even topped. Gold topped within $6 of our target.

- September 2015: Rolled out a mining stock service, and started suggesting buys on stocks like Barrick Gold Corporation (GOLD) (at $7) and Newmont Corporation (NEM) (at $16).

- December 2015: Called for a major bottom in gold the night we struck the bottom, despite the market turning extremely bearish at the time and expecting a breakdown below $1,000.

- December 2015: Called for a market top in the 2100SPX region, to be followed by a pullback towards 1800, and followed by a "global melt-up" to at least 2600SPX "no matter who gets elected" in 2016. Market bottomed at 1810, and began a strong rally to 2872.

- November 2018: Called for a bottom in TLT in the 112/113 region, with the expectation of a larger rally to follow. TLT bottomed at 111.90, and rallied to 179.70, despite the Fed still strongly raising rates at the time it bottomed.

- December 2019: Called for a 30% correction to begin in the first quarter of 2020. We began the COVID Crash in February of 2020.

- March 2020: Called for a major market bottom at 2200SPX, with an expectation of a rally to at least 4000SPX. Market bottomed within 13 points of our target.

- April 2022: Suggested to cash in most of our NEM positions (bought in 2015 at $16) in the $84/85 region. NEM topped at 86.37 and proceeded to drop 57% immediately thereafter.

- October 2022: Called for a bottom to the SPX in the 3500SPX region on the day that a much worse-than-expected CPI report was published, with an expectation that we will rally to 4300+ from there.

This now brings me to our view of the overall stock market.

Elliottwavetrader.net

As you can see from the chart above, we're expecting a very large and potentially long-term bear market. Our expectation is based on the completion of a long-term bull market; a long-term bull market which was actually called for by Ralph Nelson Elliott back in 1942. But, we're now approaching the conclusion of that bull market, which will then likely usher in the longest bear market we have experienced over the last 100 years.

And it comes at a point in time wherein most market participants do not believe it can happen. In fact, this is the typical comment I see from professionals and individual investors alike (with these being from a self-purported 43-year market professional):

"USA stock prices have always gone higher. . . . The US Stock market always ends "up" … going higher, over time … it is what we do . . . bank runs are really not a big deal unless everyone wants out today."

But he views the market from a very linear perspective. So, of course, while the market has been up during the last 43 years, with only one nine-year period of sideways market action (2000-2009), I want to point out that the next bear market we expect is of a degree higher than the one seen in 2000-2009. In fact, it is of the same degree as the Great Depression, based on our analysis.

Moreover, since the Great Depression was kicked off by a relatively short three-year market crash, it did represent an over 80% drop in the stock market. Our expectation for the coming bear market is approximately a 62%-80% stock market decline. But the difference is that it will likely be over a longer period of time, estimated to be between 13-21 years. This longer period of time can see financial pressure continue within the banking industry, and cause greater devastation relative to that seen during the Great Recession.

So, let's review some historical market perspectives.

Approximately 50% of banks failed over the 13-year period which began with the 1929 stock market crash. In comparison, approximately only 10% of banks failed during the 3 years of banking woes which were related to the Great Recession (as banking weakness abated after those 3 years). And, in further comparison, approximately 30% of Savings and Loans failed during the S&L crisis from 1986-1995.

What we can glean from history is that due to how relatively short the pain was during the Great Recession (a little over one year), it caused the fewest number of bank failures. Yet, with the expectation of what could be a much more protracted financial crisis which is likely on the horizon, we could see a much higher percentage of bank failures, more likely in the 30-50% range as seen in prior longer periods of economic woe.

Back in 2017, then Fed Chair Janet Yellen figuratively patted herself on the back when she said that the banking system is "very much stronger" due to Fed supervision and higher capital levels. She then followed that up with what I believe will be a history-making statement. Yellen also predicted that because of the measures the Fed has taken, another financial crisis is unlikely "in our lifetime." I think Janet Yellen's statement will be tossed on the heap of other similar statements of market hubris, as the financial statements of many banks are suggesting otherwise.

Consider that even though 30%-50% of banks could wind up failing, it does suggest that 50%-70% of banks would likely survive. In my opinion, it behooves each and every one of you to do the appropriate due diligence necessary to make sure that your hard-earned money resides in only the safest banks you can find. Moreover, now is the time to properly position yourself rather than waiting until the rest of the market begins to recognize the issues that are clearly present in the balance sheets of many banks across the country.

So, over the last two years, we have been writing an ongoing series of articles on bank stability, and at the request of many followers, we have been addressing the major risks we foresee for bank stability in the coming years. In fact, we have reviewed many larger banks in our public articles. But I must warn you. The substance of that analysis is not looking too good for the future of the larger banks in the United States, details for which are here.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you have likely only seen the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail well before anyone even considered these issues. And I can assure you that they have not yet been resolved. It's now only a matter of time.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not.