Auto Loans And Credit Card Delinquencies Are Flashing Strong Warnings

The NY Fed recently released its regular household debt report for the fourth quarter of 2024.

In our view, there are two key takeaways from this report. First, despite lower policy rates and various comments from analysts and management of larger banks, credit card delinquency rates continued to increase in the fourth quarter and are now less than 300 bps below the peak seen during the Great Recession. As we mentioned in our previous articles, under the current economic conditions—which remain relatively benign for households—the Great Financial Crisis (GFC) peak will likely be surpassed in late 2025 or early 2026. If there is even a mild increase in unemployment, this level could be reached much sooner.

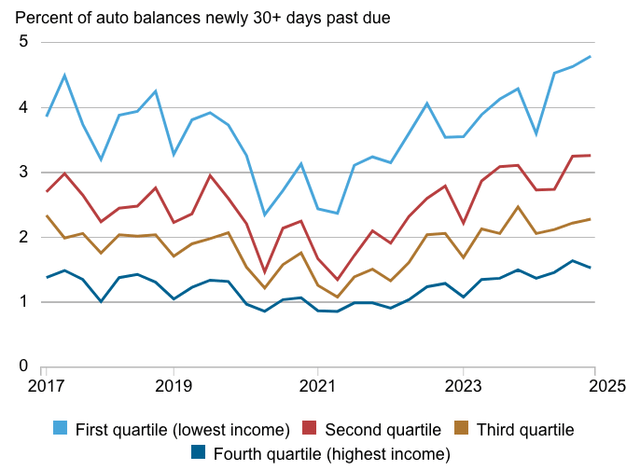

The second key takeaway is the sharp deterioration in auto loans. The delinquency ratio for auto loans is now less than 100 bps below the GFC peak. Even more importantly, while delinquencies on auto loans in the first half of 2024 were predominantly among lower-income borrowers, this is no longer the case. According to Wilbert van der Klaauw, Economic Research Advisor at the New York Fed, high auto loan delinquency rates are now broad-based across credit scores and income levels.

If you follow our banking work, this major deterioration should not come as a surprise to you. Over the past 18 months, we have been saying that the situation occurring in auto lending would very likely lead to major issues.

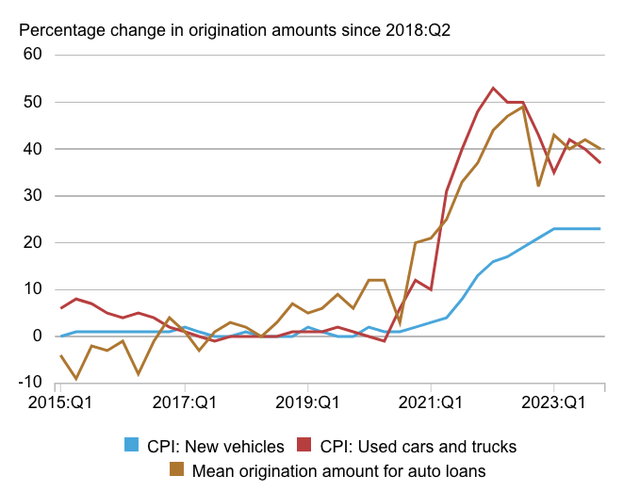

As the chart below demonstrates, higher car prices have led to a significant increase in the average origination amount for auto loans.

NY Fed

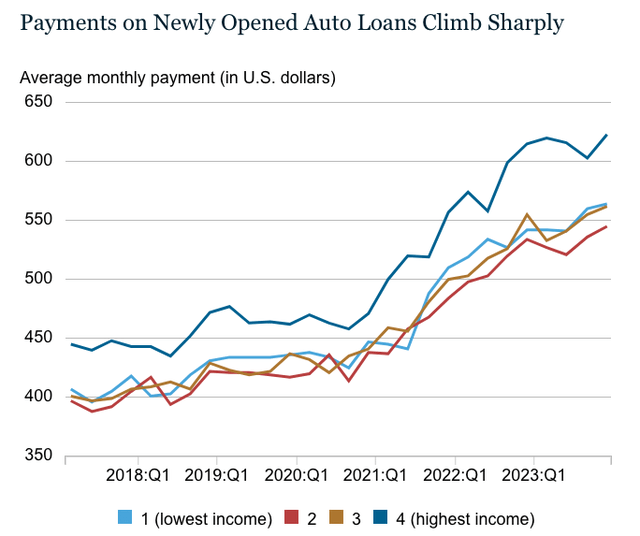

A combination of larger loan origination amounts and higher interest rates has caused a sharp spike in average monthly payments for auto loans.

NY Fed

Notably, while the first chart shows that loan origination amounts declined somewhat in the second half of 2023, this did not translate into lower average monthly payments, as they continued to rise.

Unsurprisingly, this combination of factors has driven an increase in delinquency ratios. While this deterioration was initially contained among lower-income borrowers, it is now an issue for all borrower groups, as the chart below demonstrates.

NY Fed

Some of our readers might argue that auto lending represents a relatively small share of the banking sector’s total credit portfolio. According to the latest available data, auto loan balances stand at $1.66T, accounting for around 13% of the sector’s total credit portfolio. While this might seem insignificant at first glance, the figure looks very different when compared to bank equity, as auto loans account for nearly 70% of the sector’s total capital. Moreover, if you are familiar with our other work, you know that there are significant issues in other lending segments, such as commercial real estate, lending to shadow banks, credit cards, commercial loans, and even multifamily lending, all of which are showing strain. We believe it is only a matter of time before the dominoes begin to fall.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets.

These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to review and utilize our due diligence methodology here.