A 6th High Risk Issue For Banks Is Emerging

Our latest article on bank safety: A 6th High Risk Issue For Banks Is Emerging.

If you follow our banking analysis, you know that there are currently five major issues on bank balance sheets: commercial real estate exposure, rising consumer debt risks (approaching 2007 levels), underwater long-term securities holdings, over-the-counter derivatives, and high-risk shadow banking activities. However, other significant risks exist, which we've previously covered. These include the high concentration of trading assets at the largest banks – with JPMorgan holding approximately half of the total – bank operations involving high-risk CLOs (collateralized loan obligations), and substantial non-US lending exposure among the Top 10 banks.

Additionally, when we first published our methodology, we clearly identified C&I (commercial & industrial) lending as another major risk:

"We have excluded banks with high shares of commercial & industrial loans and individual unsecured lending, as these represent very risky credit types historically most impacted by unfavorable macroeconomic changes."

Although C&I lending appeared stable when we published our methodology, we anticipated significant problems due to forward-looking indicators: poor underwriting standards, disregard for basic risk-management principles, widespread lack of C&I lending expertise among banks, and the rising interest rate environment. Recent data confirms rapid deterioration in C&I credit quality, making this segment a major concern for large U.S. banks given their substantial C&I portfolios.

According to S&P Global, large US corporate bankruptcies surged in 1Q25, reaching their highest 1Q level since 2010. S&P noted that companies now face refinancing maturing debt at significantly higher interest rates than original issuance levels, creating ongoing challenges – particularly for firms with weaker balance sheets. This directly impacts the Top 25 US banks by assets, as they primarily serve large corporations.

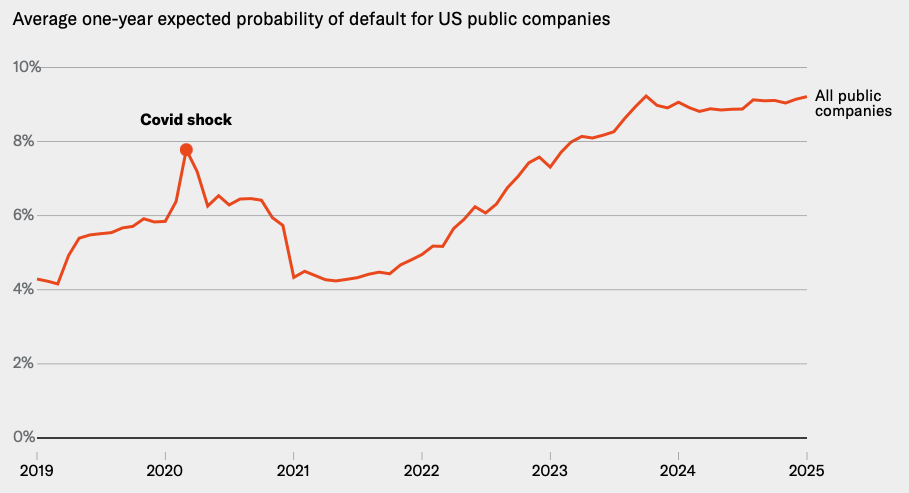

More critically, Moody's reports that default risk among approximately 5,500 US public companies has reached 9.2% – the highest level since the Global Financial Crisis. Default risk (probability of default) measures the one-year likelihood of company default.

Source: Moody’s

Moody's indicates no signs this default risk has peaked, suggesting further increases are likely in 2H25. Notably, as shown in the chart above, default probability during the COVID-19 shock was lower than current levels. Importantly, this reflects risk only for data-transparent public companies; private company default risk is likely substantially worse.

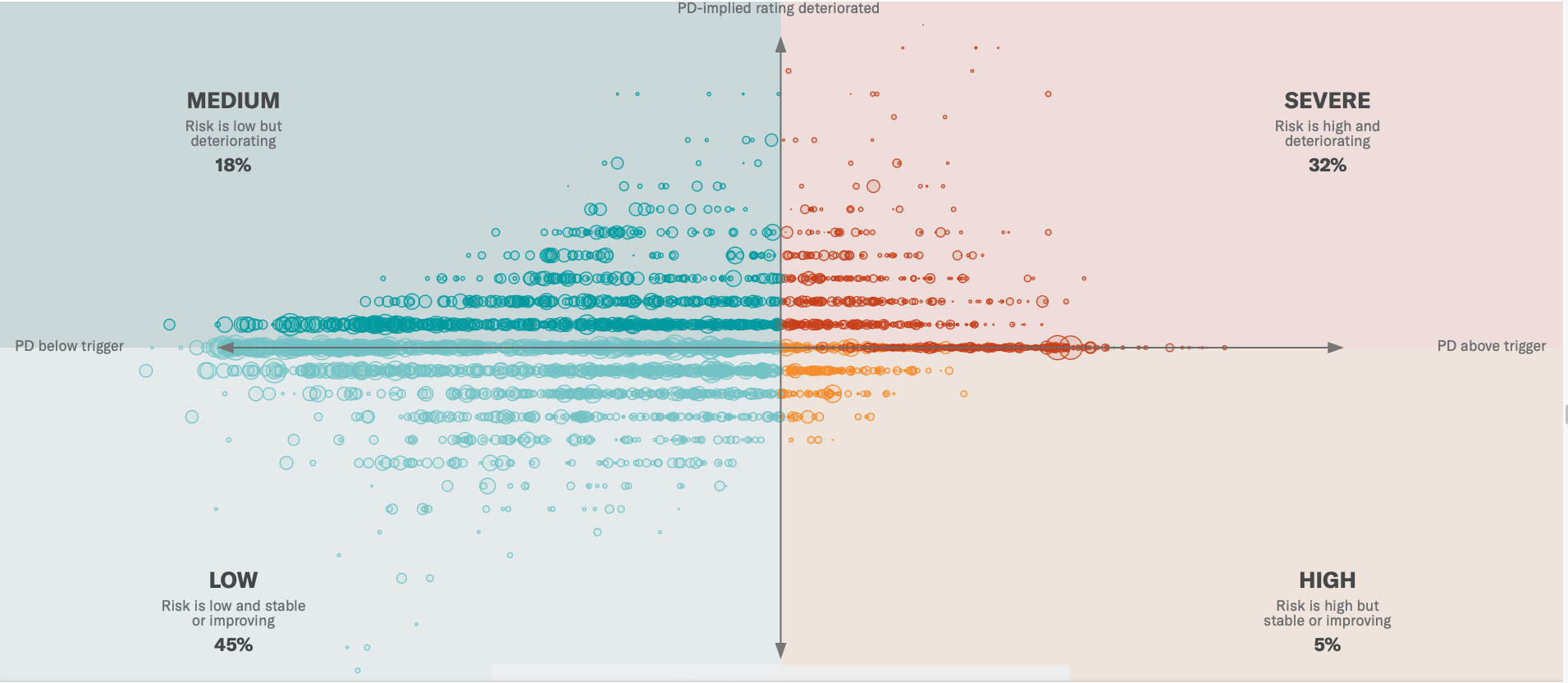

Moody's also tracks US companies exhibiting severe credit quality signals. The horizontal axis in the chart below shows a company's forward-looking probability of default relative to its industry-specific early warning threshold. When a company's default probability exceeds this level, its default risk becomes materially elevated. The vertical axis measures deterioration in the company's probability-of-default-implied rating. Together, these signals help create "watchlists" for exposures requiring close monitoring and due diligence.

Source: Moody’s

As shown, 32% of US public companies exhibited severe credit quality signals, meaning their implied ratings deteriorated over the past year while their default probability exceeded industry trigger levels. Including companies with "high" signals, 37% of US public firms are flagged as notably risky – surpassing the April 2020 peak of 35% during COVID-19's economic impact. This indicates nearly 40% of US public companies face significant default risk. As previously noted, this percentage would likely be higher if private companies were included.

Critically, the 2020 peak represented a transient external shock, whereas the current 37% reflects persistent structural issues likely to intensify over the next 12-24 months. Should even a mild crisis occur, this percentage could rise significantly, potentially triggering a default wave.

As of June 2025, US banks held $2.8T in C&I loans. With total sector equity at $2.4T, C&I loans represent 116% of equity. This substantial deterioration in C&I loan quality will likely have major negative implications for US banks, particularly larger institutions focused on C&I lending.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. You can feel free to review our due diligence methodology here.